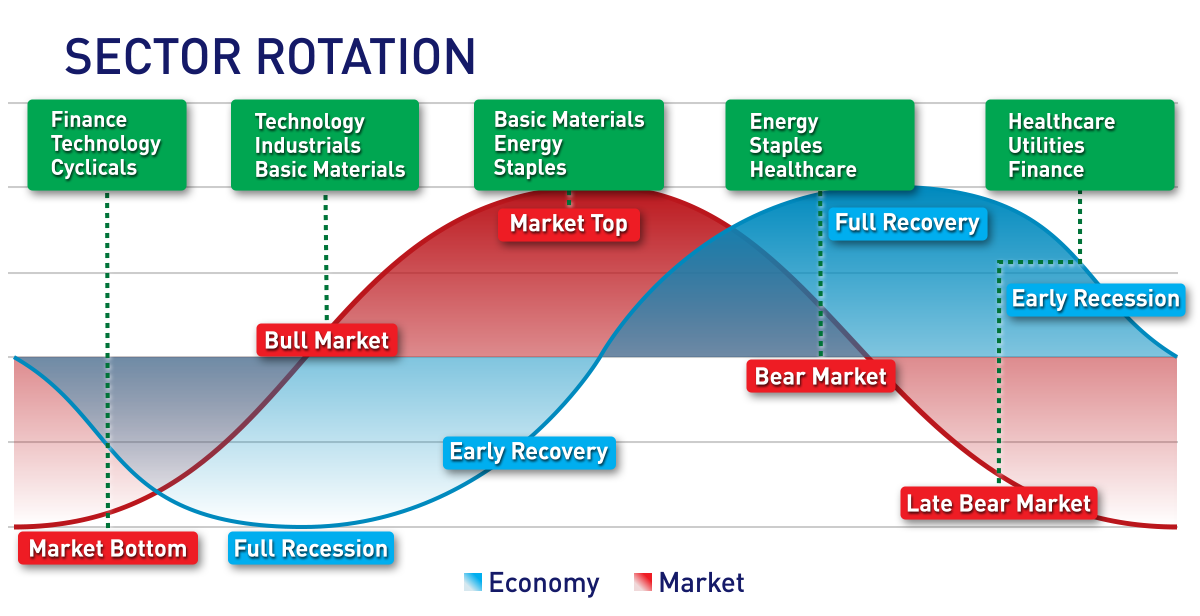

Sector Rotation Chart

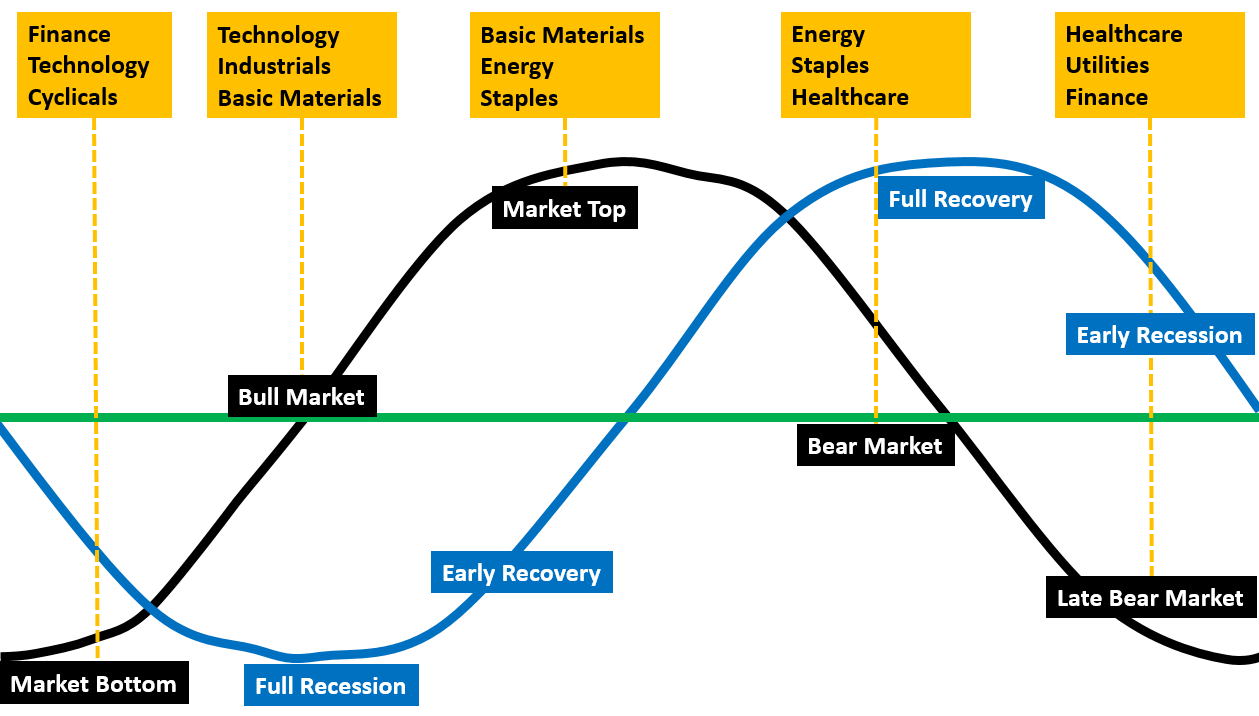

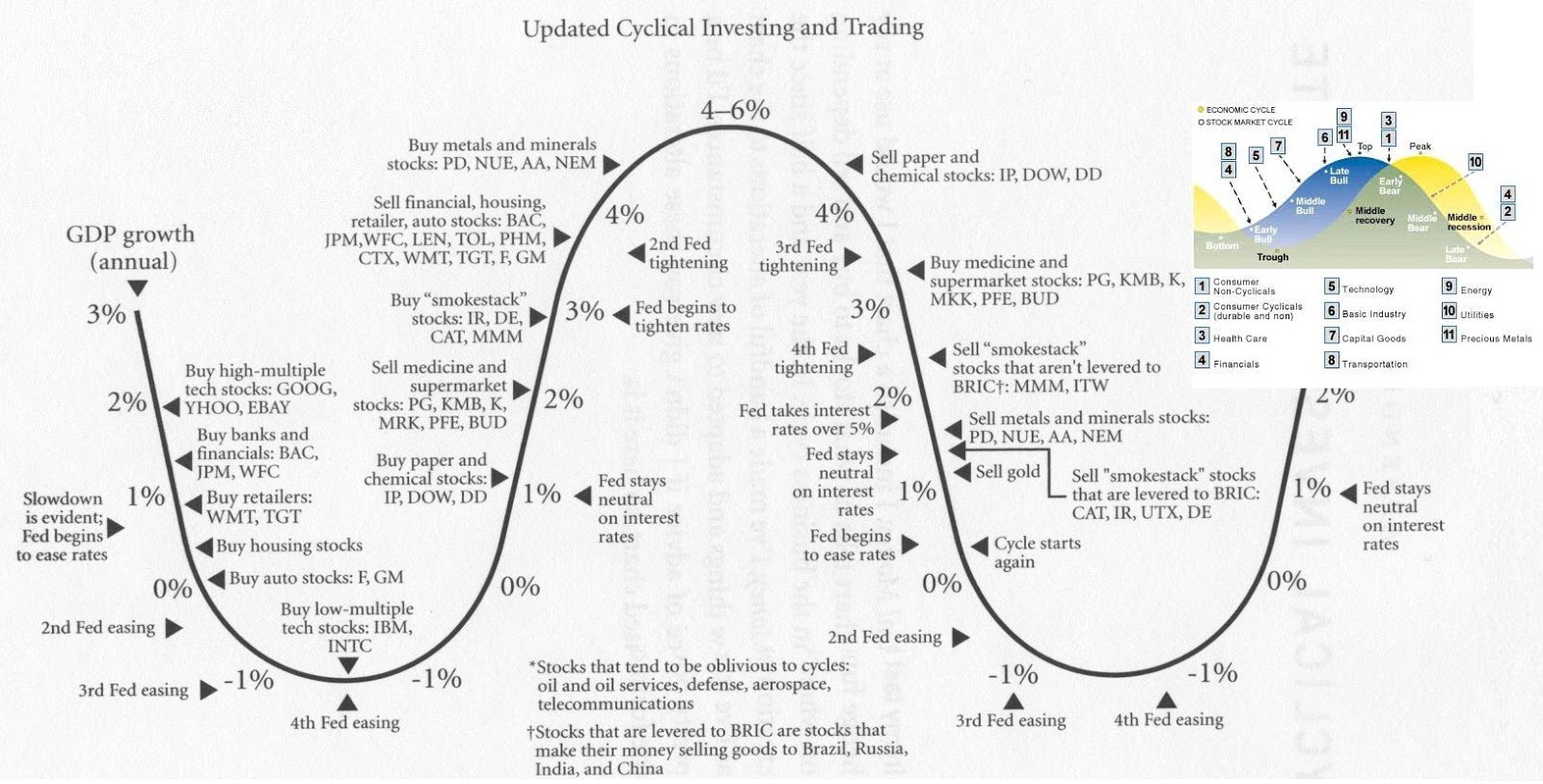

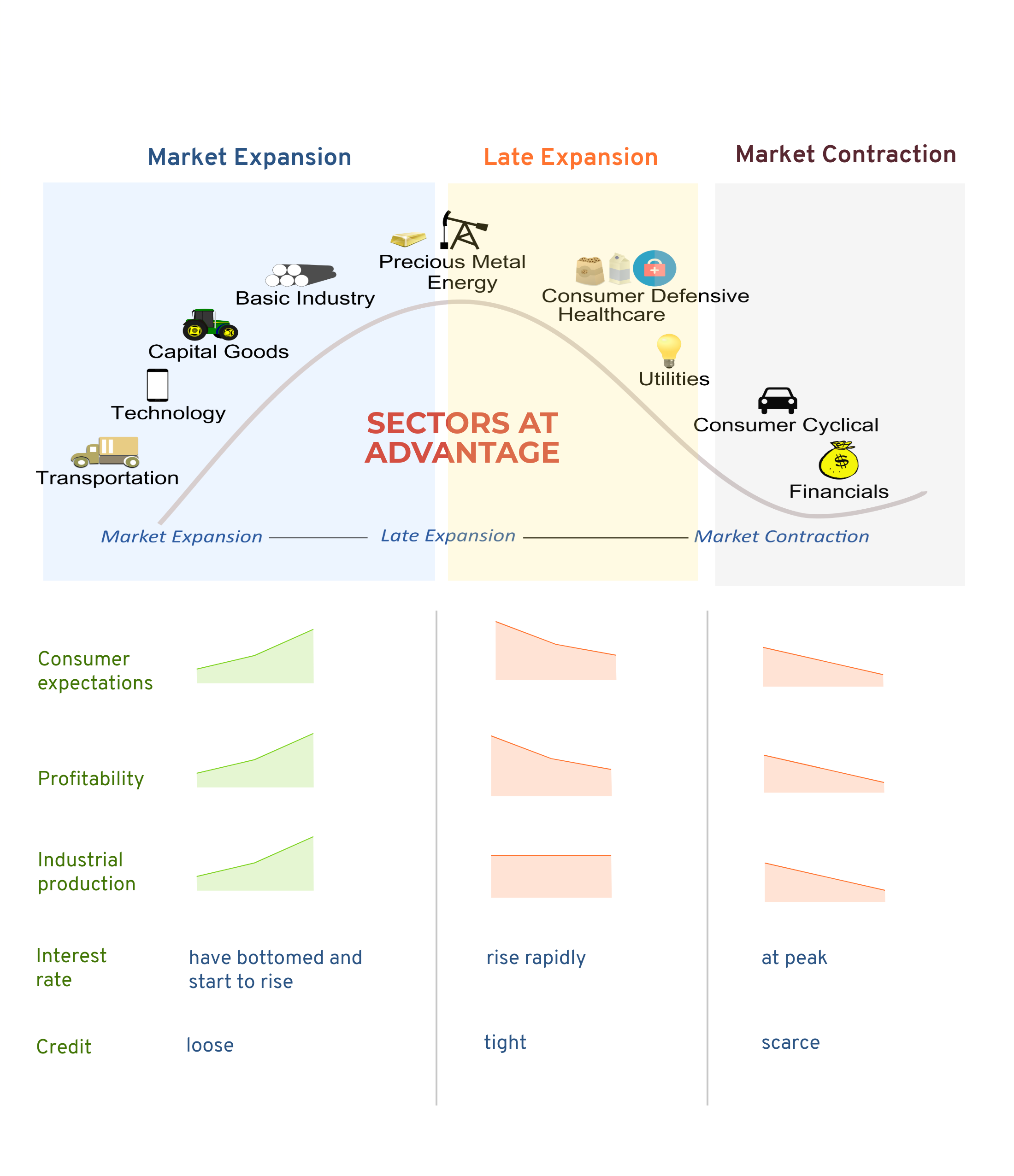

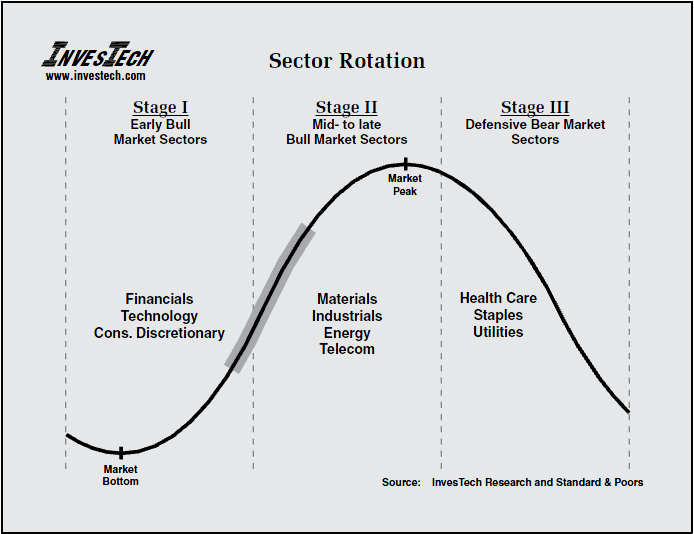

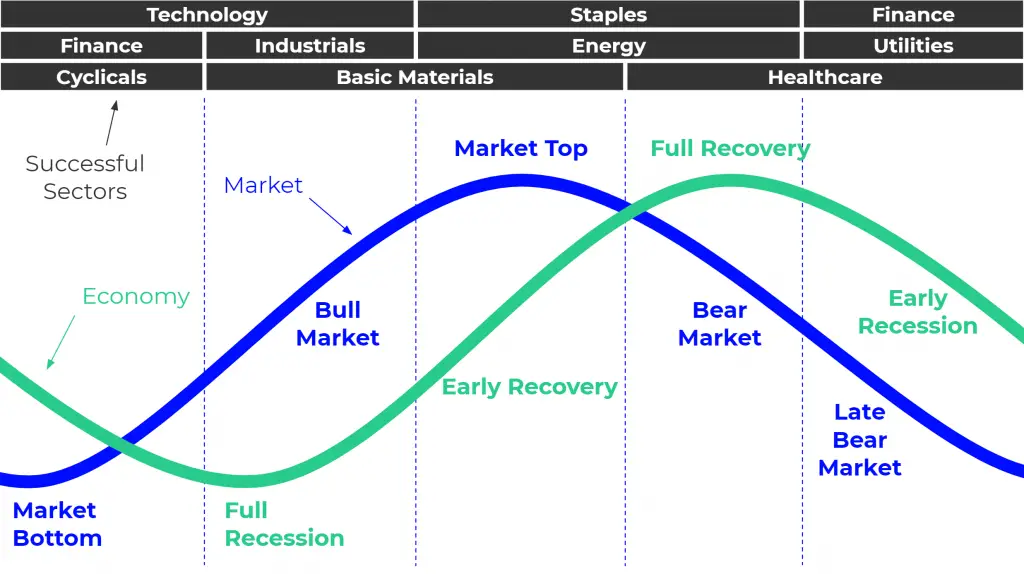

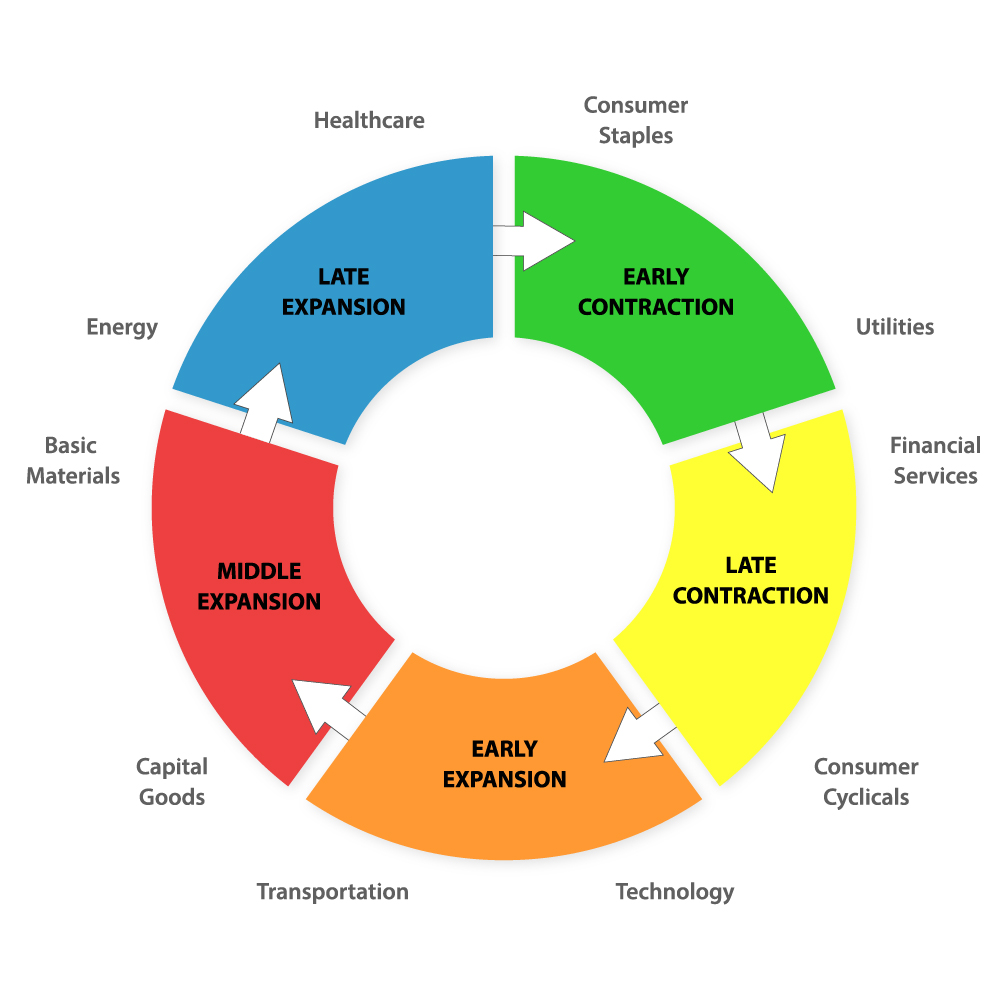

Sector Rotation Chart - The red line plots the stock market while the green line tracks the economy. Investors can use it to. Web sector rotation refers to the phenomena where money flows from one sector to another due to a variety of reasons, both fundamental, and technical. S&p 500 futures and nasdaq 100 futures dipped 0.06% and 0.09%, respectively. With an understanding of how certain sectors have typically performed during each phase of the business cycle, you may be able to position your portfolio optimally. Web sector rotation is the movement of money in the stock market from one industry to another as investors anticipate the next stage of the economic cycle. Stocks with strong relative strength and momentum appear in the green leading quadrant. Web the relative rotation graph (rrg) is a sophisticated tool in technical analysis to help investors decide which sectors, individual stocks, and other assets to pursue. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. All assets automatically update with the latest data, making for effortless creation of communication collateral. Web sector rotation refers to the phenomena where money flows from one sector to another due to a variety of reasons, both fundamental, and technical. The cboe volatility index vix rose to 16.52 on friday, finishing the week 32.6% higher, according to factset data. Always stay ahead of the curve by investing in strong performers and avoid laggers. You can see that basic industry (materials) and energy are late cycle leaders. Web get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, rsi, and much more. Web the index rotates between eleven u.s. Web rrg ® charts show you the relative strength and momentum for a group of stocks. An example of sector rotation can be money flowing from the real estate sector to the technology sector in case the real estate market becomes significantly overvalued, and starts. Web get automatic alerts—and a head start on your sector rotation game plan—when an equity or economic indicator reaches certain levels, including price, moving averages, rsi, and much more. Web investors utilize sector rotation indicators to identify the stages of economic cycles. These indicators include price momentum, economic data, and market sentiment, each providing insights for strategic investment decisions. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. An example of sector rotation can be money flowing from the real estate sector to the technology sector in case the. Web sector rotation analysis attempts to link current strengths and weaknesses in the stock market with the general business cycle based on the relative performance of the eleven s&p sector spdr etfs. All assets automatically update with the latest data, making for effortless creation of communication collateral. Web sector rotation strategies may help you align your portfolio with your market. Web sector rotation is the movement of money in the stock market from one industry to another as investors anticipate the next stage of the economic cycle. Our main interest here is with sectors which are plotted along the top of the chart. Web sector rotation strategies may help you align your portfolio with your market outlook and the different. Web investors utilize sector rotation indicators to identify the stages of economic cycles. Web sticking with the sector rotation idea, consumer staples outperformed in both hong kong and mainland china, gaining +2.08% and +2.35% on chatter that a new consumption tax won’t include liquor. Web in this week's episode of sector spotlight, i reviewed the current position of markets (sector. Web chart 1 is a visual representation of how that happens. Web sticking with the sector rotation idea, consumer staples outperformed in both hong kong and mainland china, gaining +2.08% and +2.35% on chatter that a new consumption tax won’t include liquor. Our main interest here is with sectors which are plotted along the top of the chart. Web sector. Web sector rotation analysis attempts to link current strengths and weaknesses in the stock market with the general business cycle based on the relative performance of the eleven s&p sector spdr etfs. Web the sector rotation model (srm) helps you earn outsized returns by staying in tune with the best performing areas of the market. Our main interest here is. An example of sector rotation can be money flowing from the real estate sector to the technology sector in case the real estate market becomes significantly overvalued, and starts. Web sector rotation analysis attempts to link current strengths and weaknesses in the stock market with the general business cycle based on the relative performance of the eleven s&p sector spdr. An example of sector rotation can be money flowing from the real estate sector to the technology sector in case the real estate market becomes significantly overvalued, and starts. With an understanding of how certain sectors have typically performed during each phase of the business cycle, you may be able to position your portfolio optimally. Web rrg ® charts show. As relative momentum fades, they typically move into the yellow weakening quadrant. Web sector rotation refers to the phenomena where money flows from one sector to another due to a variety of reasons, both fundamental, and technical. Web the relative rotation graph (rrg) is a sophisticated tool in technical analysis to help investors decide which sectors, individual stocks, and other. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. Web the sector rotation model (from sam stovall's guide to sector rotation) is one of those models that i like to track. Always stay ahead of the curve by investing in strong performers and avoid laggers. The index. Stocks with strong relative strength and momentum appear in the green leading quadrant. An example of sector rotation can be money flowing from the real estate sector to the technology sector in case the real estate market becomes significantly overvalued, and starts. You can see that basic industry (materials) and energy are late cycle leaders. The graph at the top shows the theoretical flow of expected outperformance as it flows through the sector landscape during various phases of the economic cycle. Web sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. Web sector rotation refers to the phenomena where money flows from one sector to another due to a variety of reasons, both fundamental, and technical. Web rrg ® charts show you the relative strength and momentum for a group of stocks. Web an program update from cybersecurity firm crowdstrike early friday triggered major it outages worldwide. Web the index rotates between eleven u.s. Always stay ahead of the curve by investing in strong performers and avoid laggers. The loss of service disrupted business operations for many airlines, banks. Web visualize sector rotation data to help you find the leading stocks. As relative momentum fades, they typically move into the yellow weakening quadrant. These indicators include price momentum, economic data, and market sentiment, each providing insights for strategic investment decisions. Web drill down into the current and past performance of the major us market sectors, their industry indexes and the individual stocks that constitute those groups. Web sector rotation is an investment strategy that involves reallocating assets among various sectors of the economy to capitalize on the performance of different industries during different phases of the economic cycle.Sector Rotation Analysis [ChartSchool]

Mind in Focus . World

Stock Market Sector Rotation Strategy and How to Profit using it.

Trading Correlation Manager Seasonal And Sector Rotation. The Distant

Sector Rotation Guides iSquare Intelligence

Sector Rotation and the Stock Market Cycle The Big Picture

Use the Correlation Between the Economy & Stock Market to Your Advantage

Sector Rotation PatternsWizard

Sector Rotation Strategy Can it Outperform The Market?

5/24 MWL Recap Sector Rotation Chart Breakouts! Turning Point

Web Chart 1 Is A Visual Representation Of How That Happens.

Investors Can Use It To.

The Cboe Volatility Index Vix Rose To 16.52 On Friday, Finishing The Week 32.6% Higher, According To Factset Data.

Web The Relative Rotation Graph (Rrg) Is A Sophisticated Tool In Technical Analysis To Help Investors Decide Which Sectors, Individual Stocks, And Other Assets To Pursue.

Related Post:

![Sector Rotation Analysis [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=market_analysis:sector_rotation_analysis:sectorcycle.png)