Hammer Chart Pattern

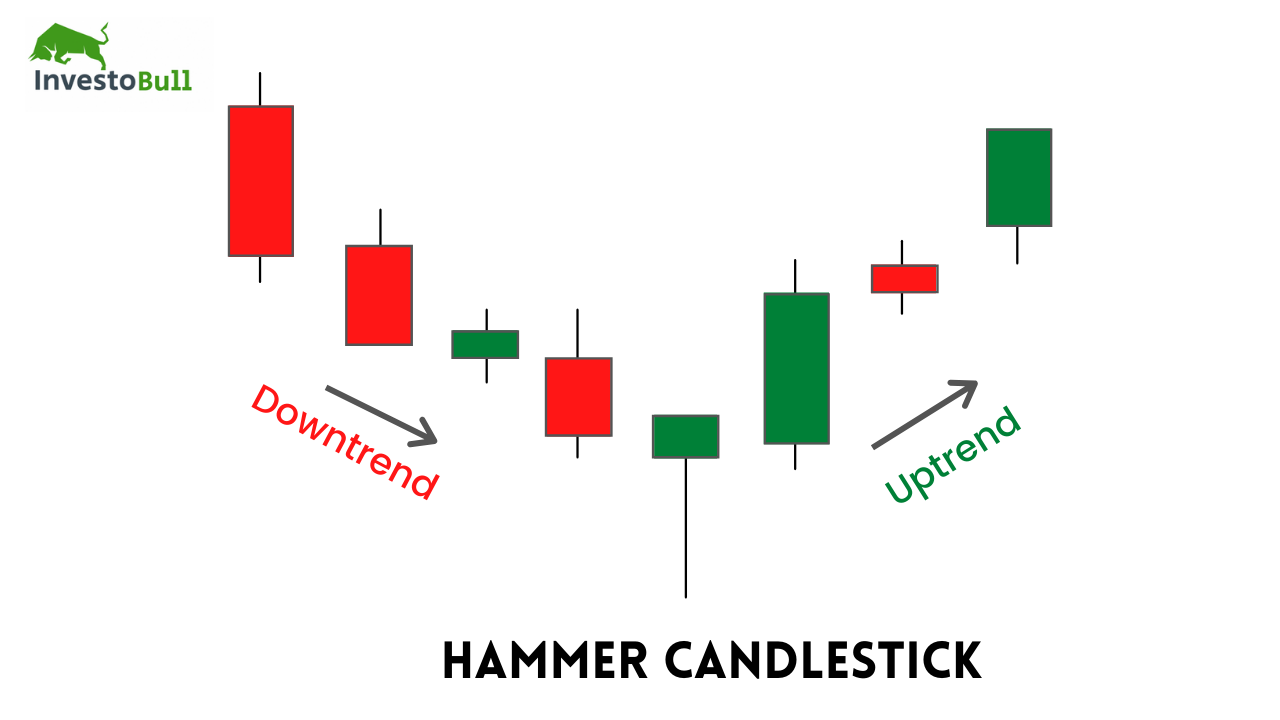

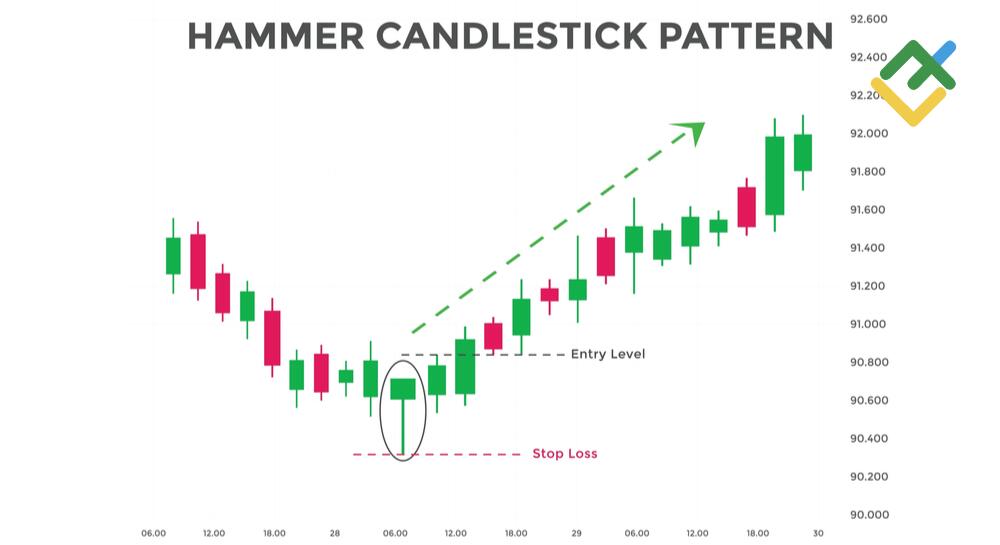

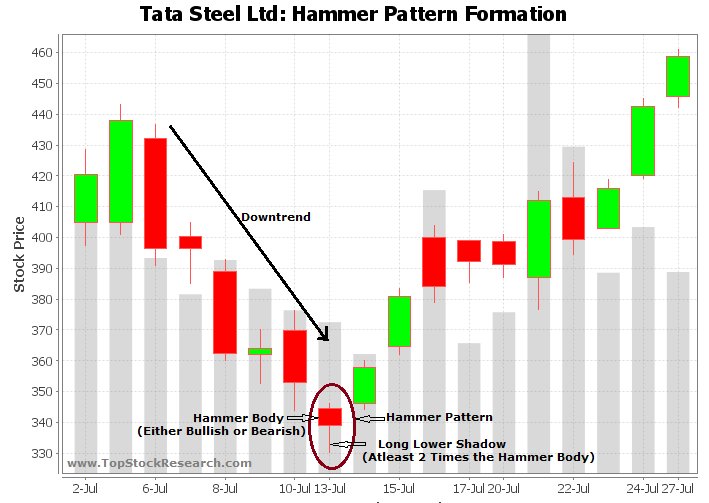

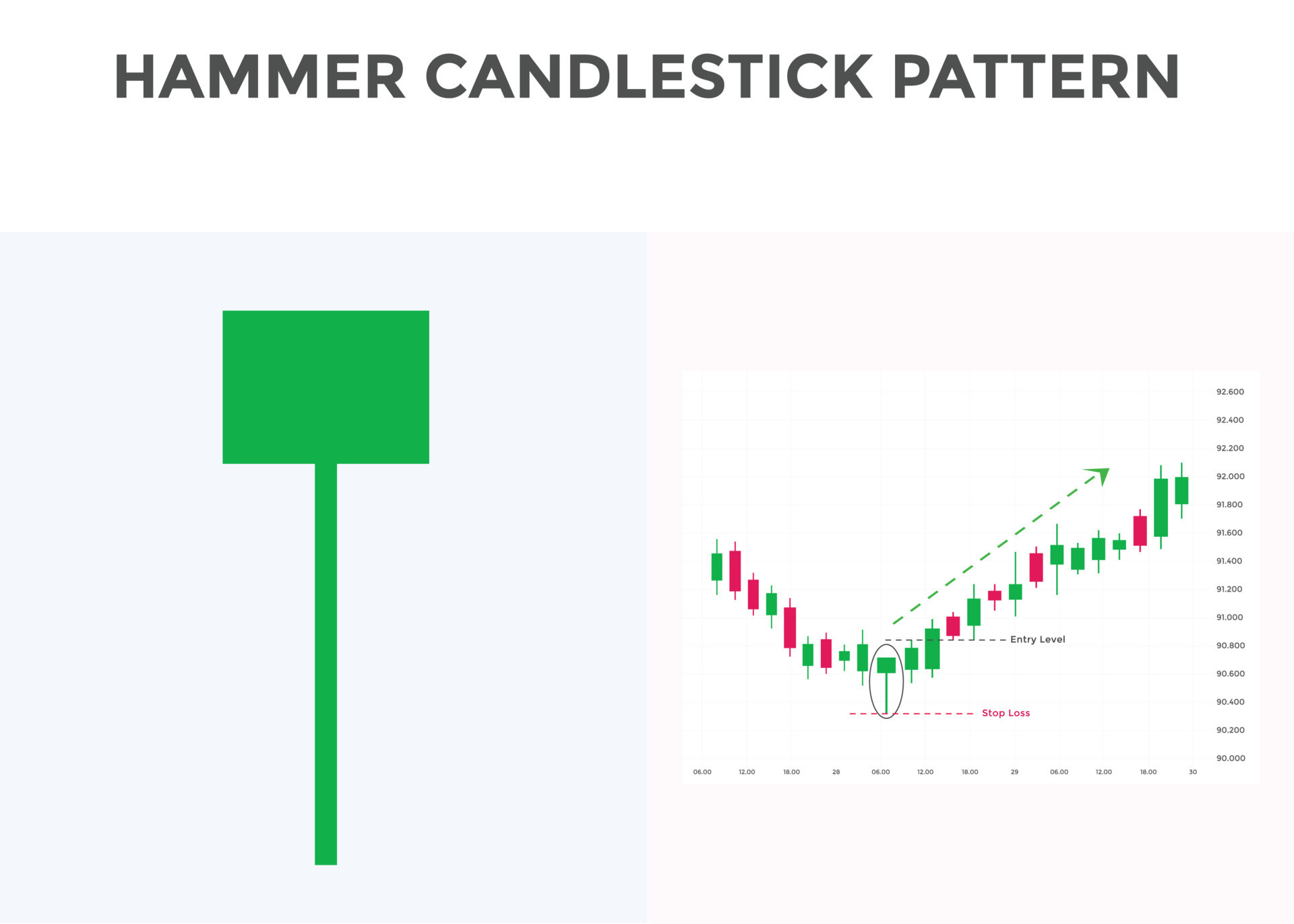

Hammer Chart Pattern - This could mean that the bulls have been able to counteract the bears to help the stock find support. In most cases, hammer is one of the most bullish candlestick patterns in the market. And, what is an inverted hammer? Web 11 chart patterns you should know. While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. Irrespective of the colour of the body, both examples in the photo above are hammers. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Can a bullish hammer be red? Web in this guide to understanding the hammer candlestick formation, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and discuss how to trade on a hammer. We will dissect the hammer candle in great detail, and provide some practical tips for applying it in the forex market. There are two types of hammers: It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. This article illustrates these patterns in this order: While the stock has lost 6.2% over the past week, it could witness a trend reversal as a hammer chart pattern was formed in its last trading session. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. In most cases, hammer is one of the most bullish candlestick patterns in the market. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Is the hammer bullish or bearish? And, what is an inverted hammer? The candles show a price decline followed by the hammer formation shadow being more than double in length compared to the hammer body. This shows a hammering out of a base and reversal setup. The information below will help you identify this pattern on the charts and predict further price dynamics. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. It is characterized by a small body and a long lower wick, resembling a hammer, hence. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. Web a downtrend has been apparent in reddit inc. It is characterized by a small body and a long lower wick, resembling a hammer, hence its name. Irrespective of the colour of the body,. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. This article illustrates these patterns in this order: It is characterized by a small body and a long lower wick, resembling a. You will improve your candlestick analysis skills and be able to apply them in trading. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. The long lower shadow of the hammer shows that the stock attempted to sell off during the trading session, but the demand for shares helped bring. Can a bullish hammer be red? The candles show a price decline followed by the hammer formation shadow being more than double in length compared to the hammer body. Learn what it is, how to identify it, and how to use it for intraday trading. The information below will help you identify this pattern on the charts and predict further. It signals that the market is about to change trend direction and advance to new heights. This article illustrates these patterns in this order: Web a hammer candle is a popular pattern in chart technical analysis. The information below will help you identify this pattern on the charts and predict further price dynamics. It manifests as a single candlestick pattern. This shows a hammering out of a base and reversal setup. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Web a hammer candlestick pattern is a reversal structure that forms at the bottom of a chart. While the stock has lost 6.2% over the past week,. What is the hammer candlestick after an uptrend? The hammer signals that price may be about to make a reversal back higher after a recent swing lower. Web the hanging man candlestick pattern is characterized by a short wick (or no wick) on top of small body (the candlestick), with a long shadow underneath. What is the hammer candlestick pattern?. This article illustrates these patterns in this order: It signals that the market is about to change trend direction and advance to new heights. Learn what it is, how to identify it, and how to use it for intraday trading. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. The hammer candlestick. Web the above chart shows what a hammer candlestick pattern looks like. When you see a hammer candlestick, it's often seen as a positive sign for investors. Our guide includes expert trading tips and examples. Is the hammer bullish or bearish? There are two types of hammers: And, what is an inverted hammer? This article illustrates these patterns in this order: What is the hammer candlestick pattern? This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. The formation of a hammer. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Chart prepared by david song, strategist; Web the first important thing is that jasmy token formed a hammer chart pattern whose lower side was at $0.0193. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. It signals that the market is about to change trend direction and advance to new heights. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. When you see a hammer candlestick, it's often seen as a positive sign for investors.Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

What is Hammer Candlestick Pattern June 2024

What is a Hammer Candlestick Chart Pattern? LiteFinance

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Patterns Chart 5 Trading Strategies for Forex Traders

Hammer Chart Pattern

Tutorial on Hammer Candlestick Pattern

Hammer pattern candlestick chart pattern. Bullish Candlestick chart

Inverted Hammer Candlestick Pattern Quick Trading Guide

What is a Hammer Candlestick Chart Pattern? LiteFinance

The Candles Show A Price Decline Followed By The Hammer Formation Shadow Being More Than Double In Length Compared To The Hammer Body.

In Short, A Hammer Consists Of A Small Real Body That Is Found In The Upper Half Of The Candle’s Range.

This Could Mean That The Bulls Have Been Able To Counteract The Bears To Help The Stock Find Support.

Web 11 Chart Patterns You Should Know.

Related Post: