Cup Handle Chart

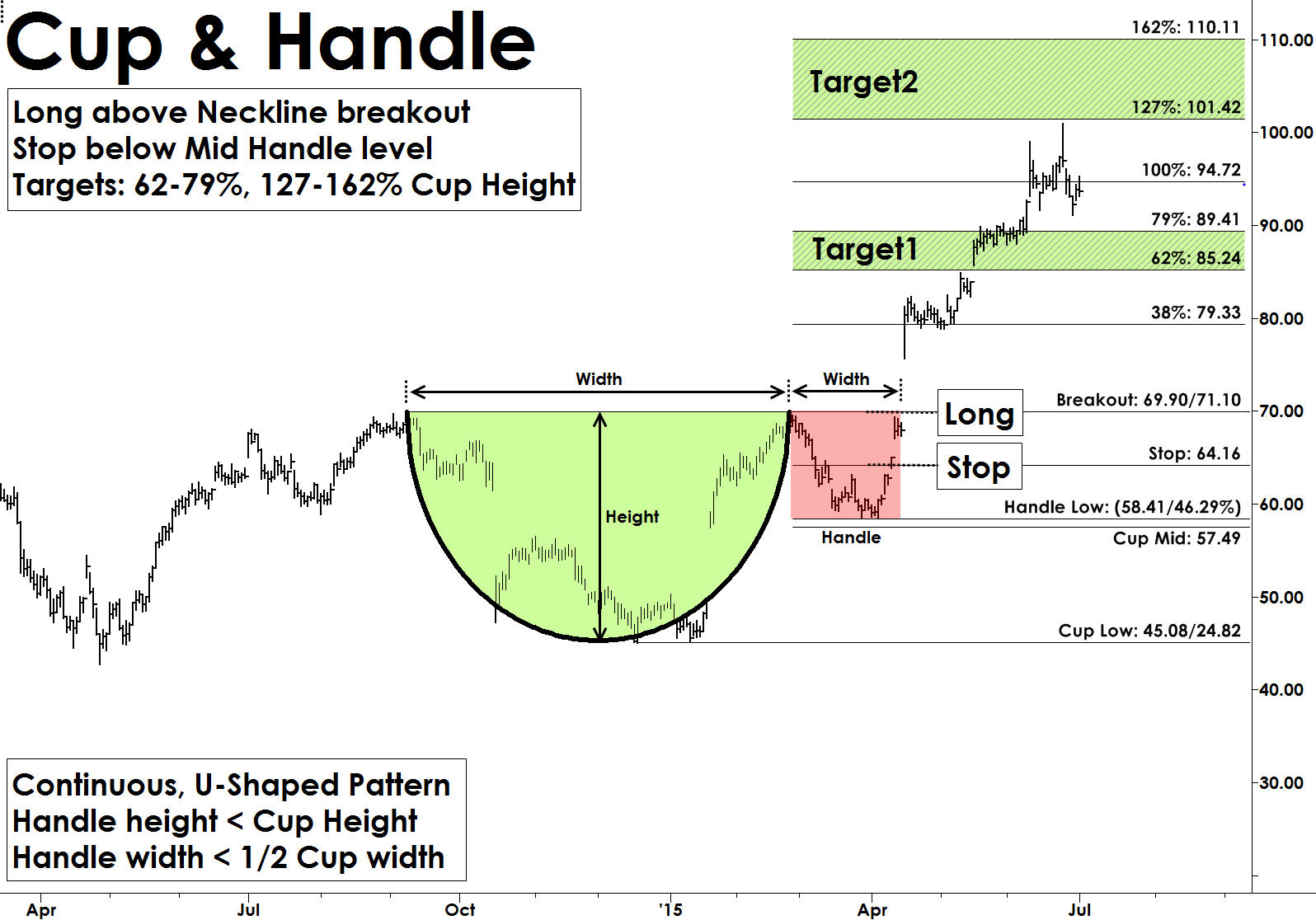

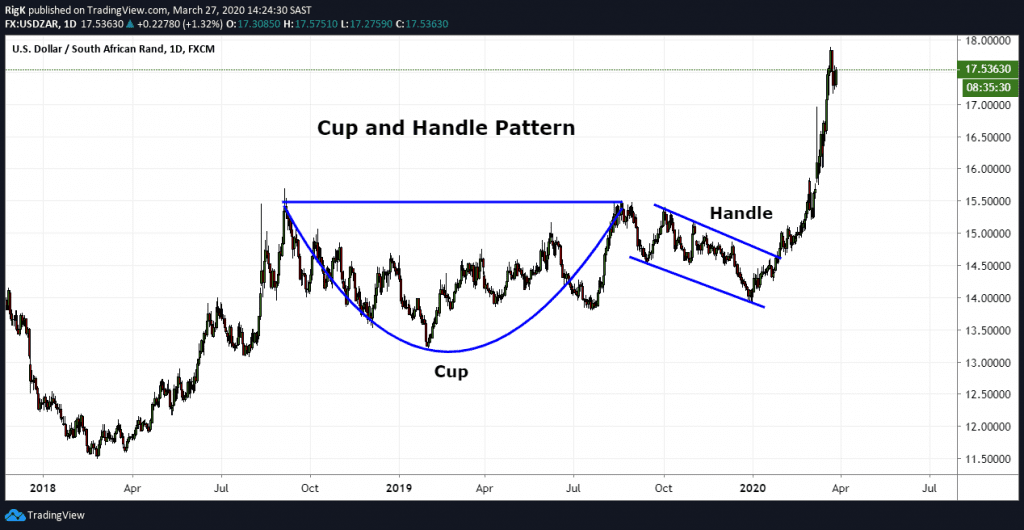

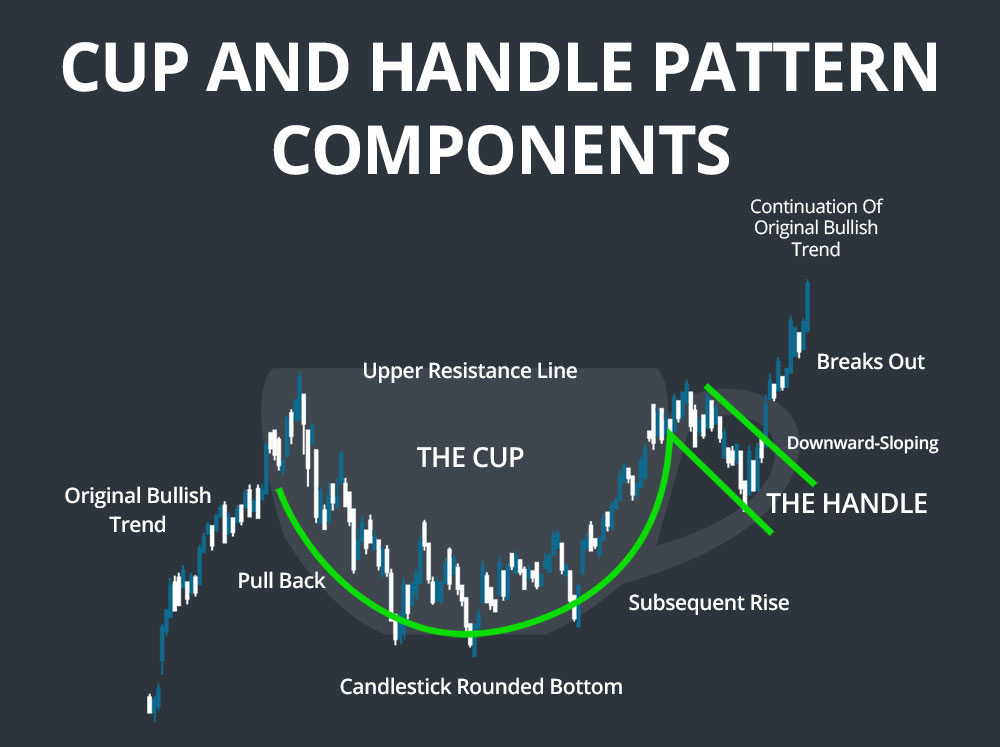

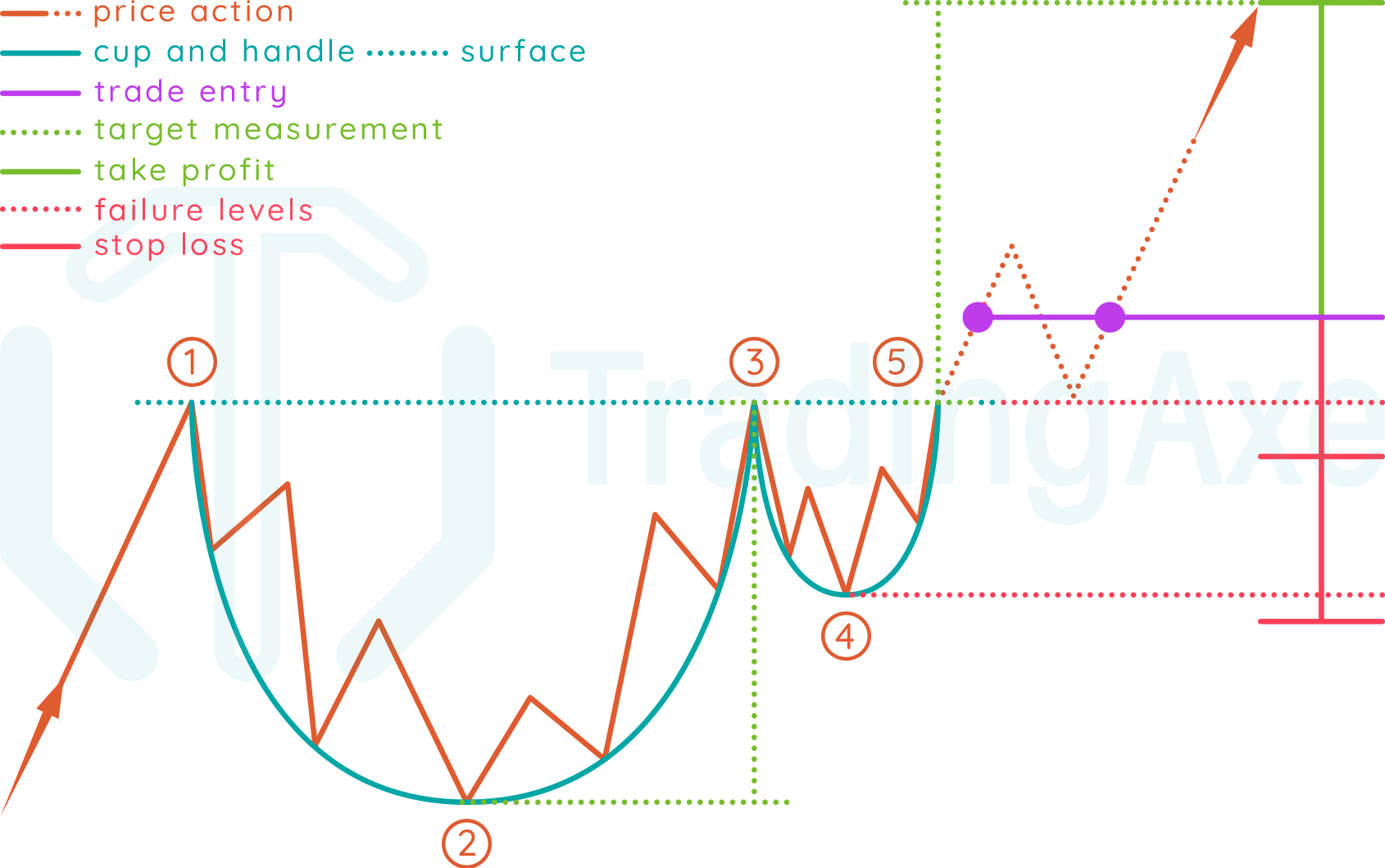

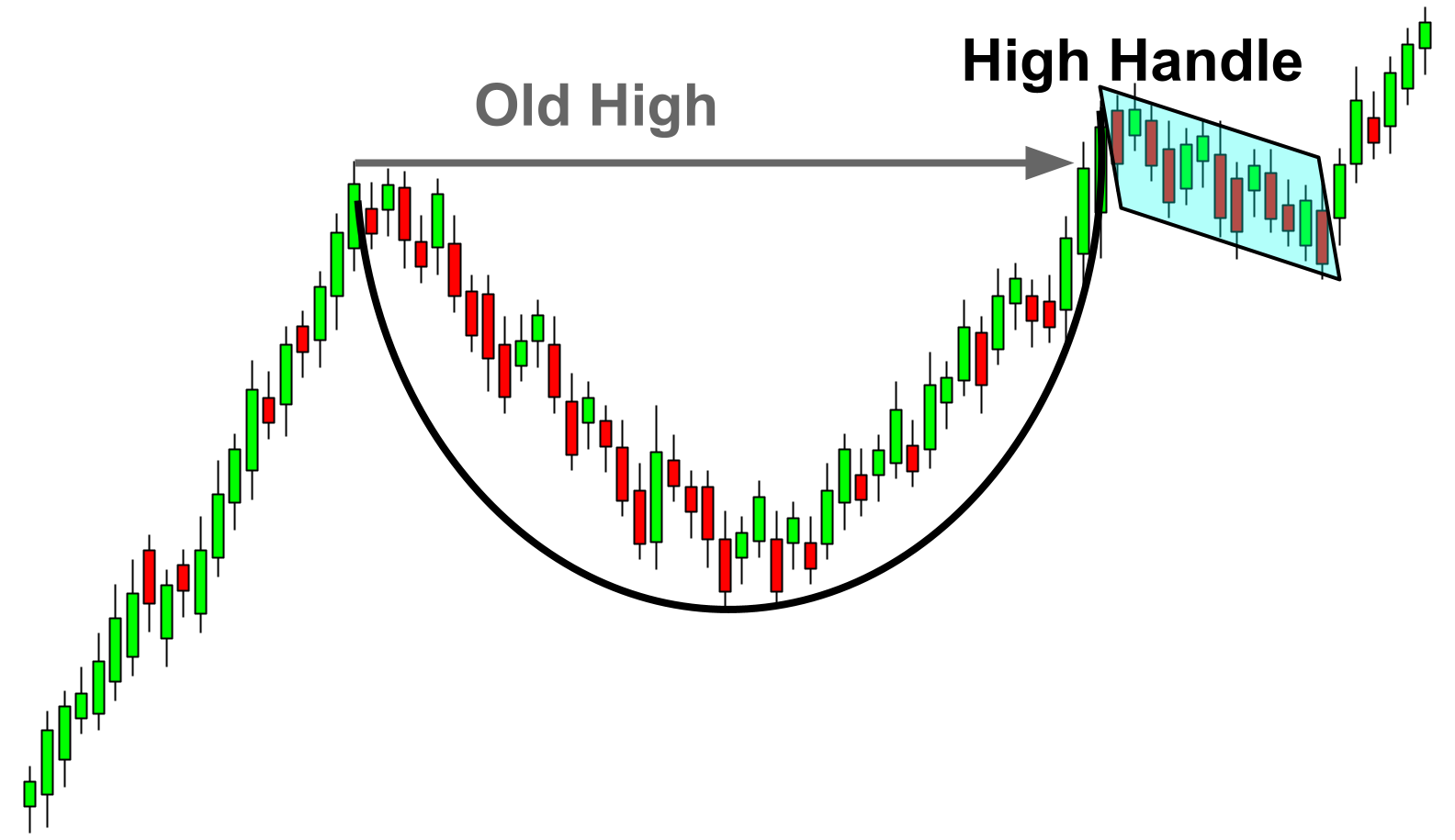

Cup Handle Chart - The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. Learn how to read this pattern, what it means and how to trade. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Web do you know how to spot a cup and handle pattern on a chart? The cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. This pattern is known for its reliability and has been widely used by traders to identify potential trend reversals and continuation opportunities. Let's consider the market mechanics of a typical. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. It gets its name from the tea cup shape of the pattern. Web “cup and handle is a bullish technical pattern resembling a tea cup on a price chart, indicating potential for a breakout to new highs after a period of consolidation.” originating in the stock market and popularized by william o’neil, the cup and handle pattern serves as a powerful tool for traders forecasting bullish momentum. It is believed that after the breakdown of the handle, the price will go further in the direction of the trend by. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web the cup and handle pattern is a bullish continuation pattern that consists of two parts, the cup and the handle. Web the cup and handle pattern strategy is a formation on the price chart of an asset that resembles a cup with a handle. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Web almost every pattern has its opposite. The cup pattern happens first and then a handle happens next. Learn how to trade this pattern to improve your odds of making profitable trades. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. The handle — a tight consolidation is formed under resistance. It is important to note that the cup’s shape can vary, with some being shallower or deeper than others. The bottom of the cup represents the low point of the stock’s price. What is the cup and handle pattern? It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. There are two parts. The bottom of the cup represents the low point of the stock’s price. The cup forms after an advance and looks like a bowl or rounding bottom. It is a bullish continuation pattern that marks a consolidation period followed by a breakout. There are 2 parts to it: It is believed that after the breakdown of the handle, the price. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. It is a bullish continuation pattern that marks a consolidation period followed by a breakout. As its name implies, the pattern consists of two parts — the cup and the handle. And once you do, where is. And once you do, where is the buy point? The cup pattern happens first and then a handle happens next. Let's consider the market mechanics of a typical. Learn how to read this pattern, what it means and how to trade. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. Web “cup and handle is a bullish technical pattern resembling a tea cup on a price chart, indicating potential for a breakout to new highs after a period of consolidation.” originating in the stock market and popularized by william o’neil, the cup and handle pattern serves as a powerful tool for traders forecasting bullish momentum. Web a ‘cup and handle’. But how do you recognize when a cup is forming a handle? As you can see, the cup is just under two thirds the height of the first move up, and shows rounded price action, rather than a sharp pullback. It gets its name from the tea cup shape of the pattern. Web updated on march 29, 2023. There are. As its name implies, the pattern consists of two parts — the cup and the handle. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. The handle — a tight consolidation is formed under resistance. The cup forms after an advance and looks like a bowl. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. It gets its name from the tea cup shape of the pattern. Web a cup and handle pattern is a bullish pattern that. Web the cup and handle is a powerful and reliable chart pattern of technical analysis that frequently leads to big gains. Web one such chart pattern that has proven to be powerful for financial traders is the cup and handle pattern. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It is. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. But how do you recognize when a cup is forming a handle? Web one such chart pattern that has proven to be powerful for financial traders is the cup and handle pattern. It gets its name from the tea. Learn how to trade this pattern to improve your odds of making profitable trades. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. It is important to note that the cup’s shape can vary, with some being shallower or deeper than others. The cup pattern happens first and then a handle happens next. There are 2 parts to it: Web one such chart pattern that has proven to be powerful for financial traders is the cup and handle pattern. Web a cup and handle pattern is a bullish pattern that has a cup base with a handle formation. The bottom of the cup represents the low point of the stock’s price. Web what is a cup and handle chart pattern? Deconstructing the cup and handle. As you can see, the cup is just under two thirds the height of the first move up, and shows rounded price action, rather than a sharp pullback. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. Web the cup and handle pattern is a bullish continuation pattern that consists of two parts, the cup and the handle. Web do you know how to spot a cup and handle pattern on a chart? It's the starting point for scoring runs. The cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards.Cup and Handle Definition

Cup and Handle Pattern Meaning with Example

Cup and handle chart pattern How to trade the cup and handle IG UK

(12/09/20) Trading Bank Stocks Cup&Handle Chart Patterns

The Cup and Handle Chart Pattern (Trading Guide)

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

How To Trade Cup And Handle Chart Pattern TradingAxe

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

It Is Considered One Of The Key Signs Of Bullish Continuation, Often Used To Identify Buying Opportunities.

But How Do You Recognize When A Cup Is Forming A Handle?

Web The Cup And Handle Is One Of Many Chart Patterns That Traders Can Use To Guide Their Strategy.

It Is Believed That After The Breakdown Of The Handle, The Price Will Go Further In The Direction Of The Trend By.

Related Post:

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)