Credit Spreads Chart

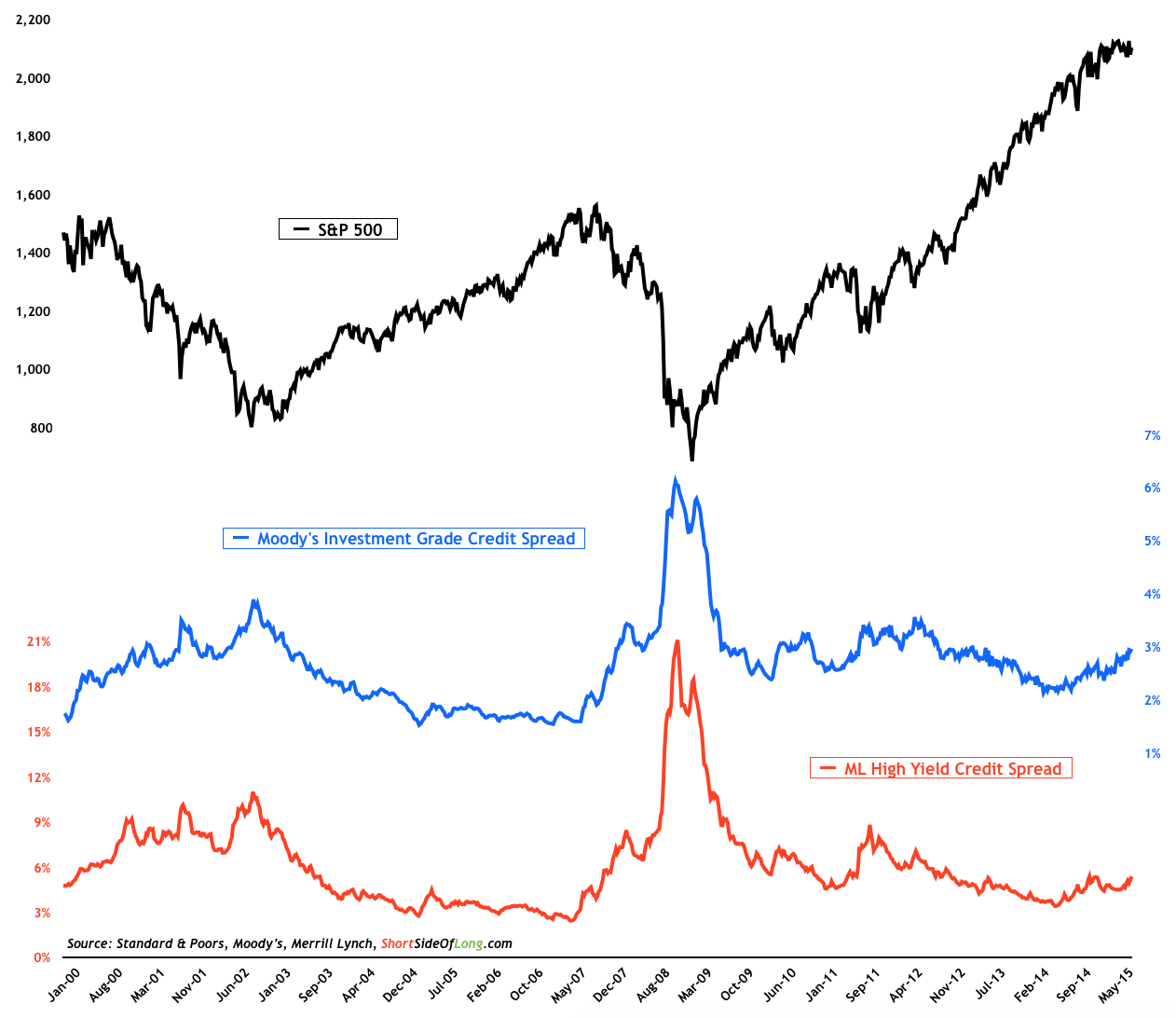

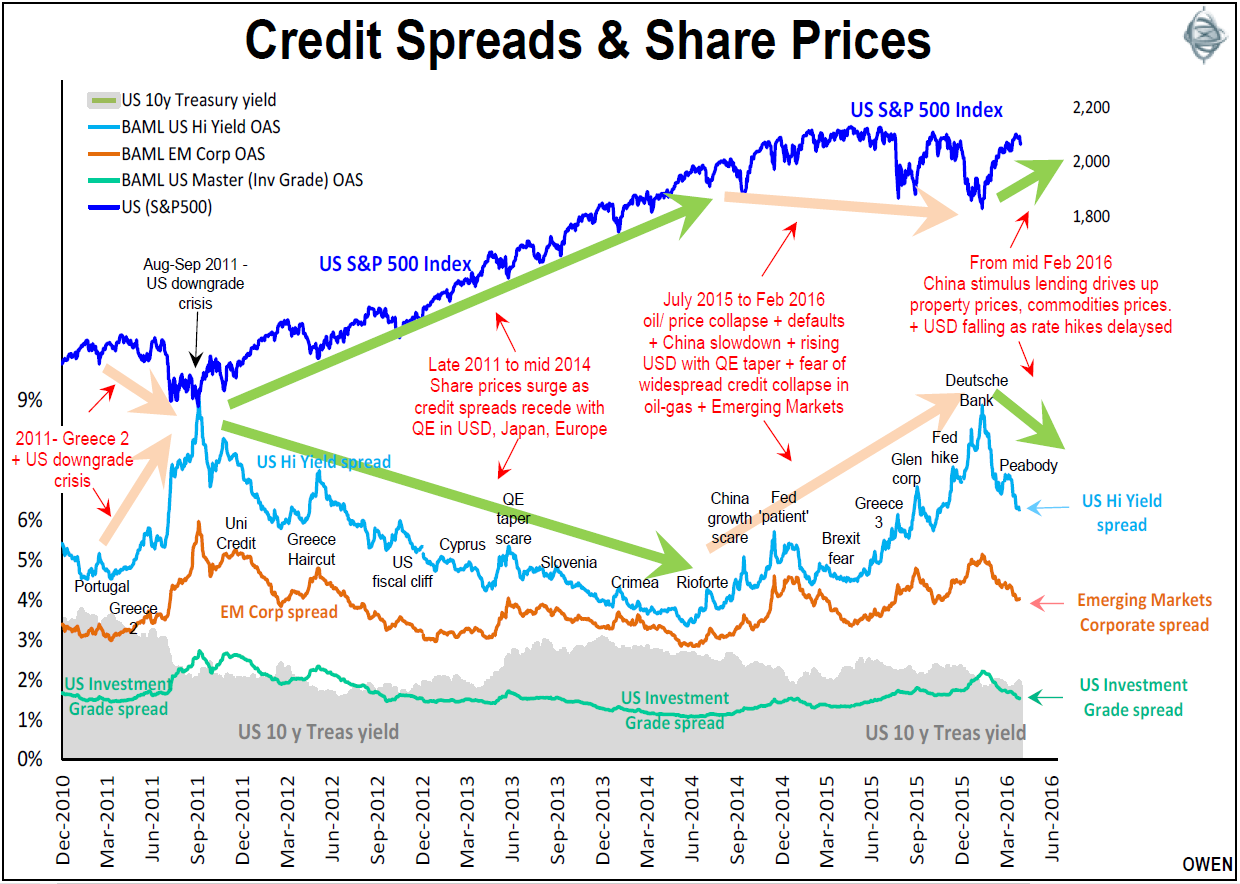

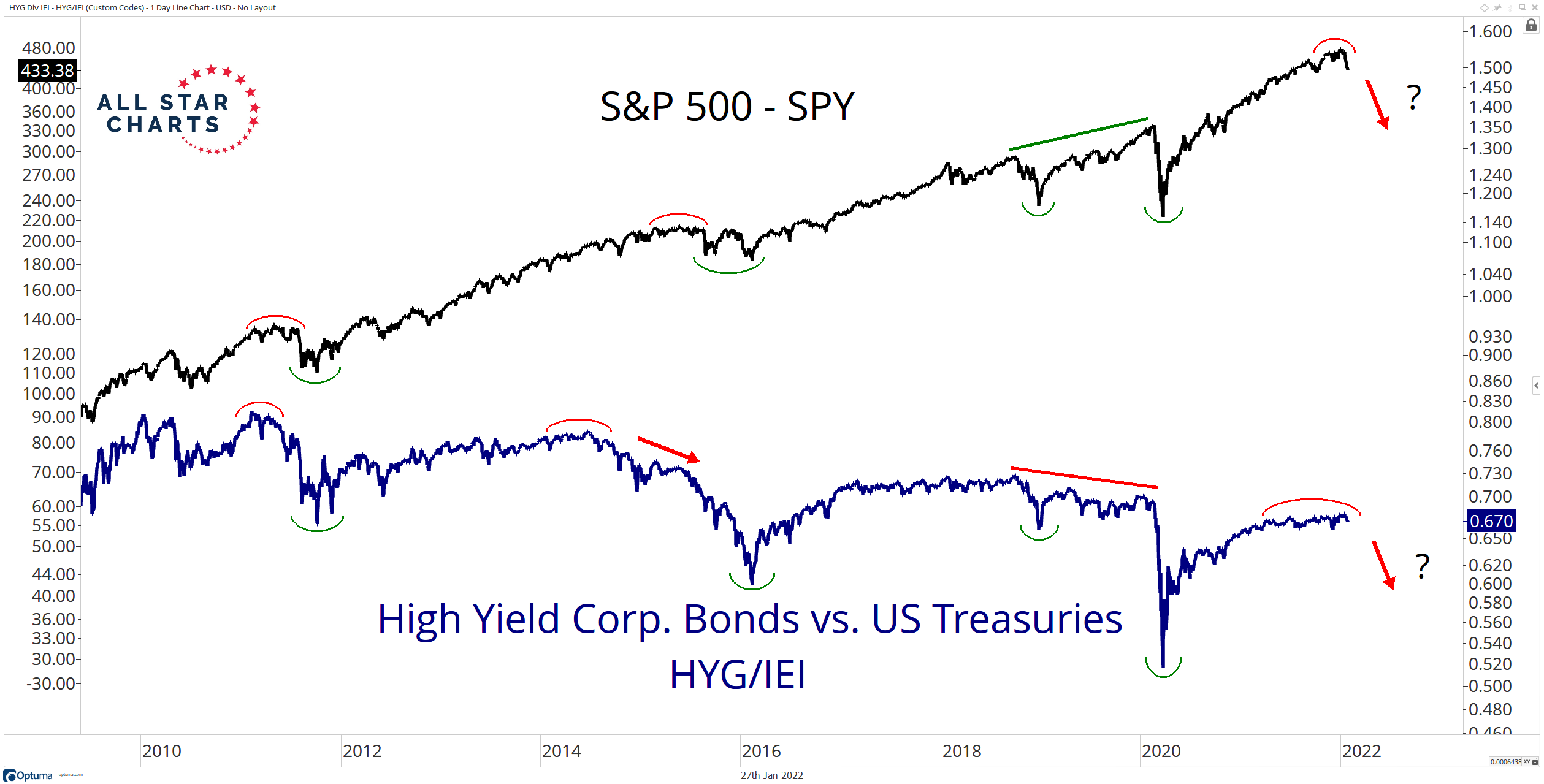

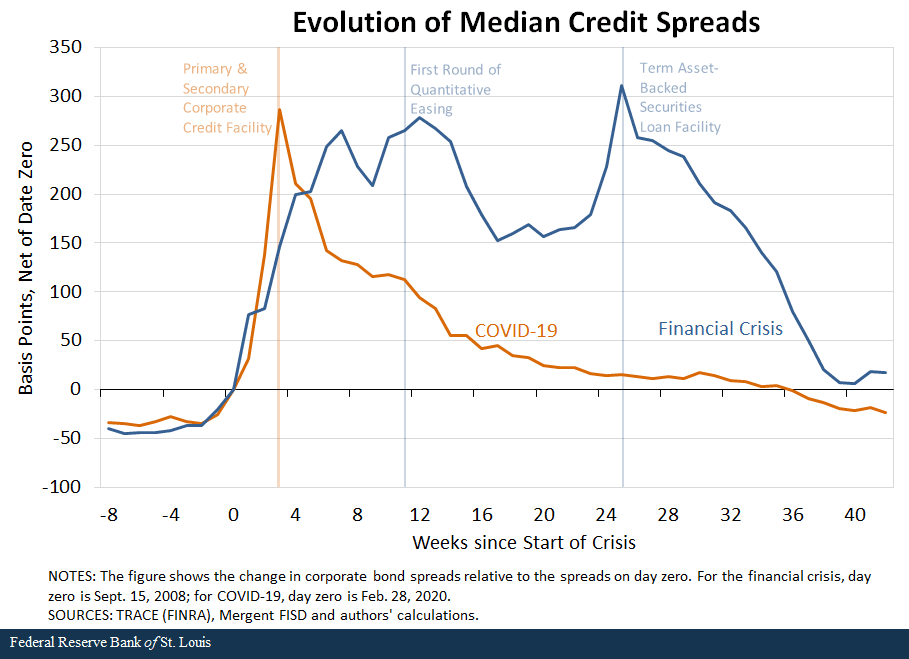

Credit Spreads Chart - The flags mark the beginning of a recession according to wikipedia. Web the credit risk spread has a negative correlation with the stock market. Web a credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. The us credit spread includes us aaa credit. The outage resulted from an issue. Individuals in this tier have a positive, above average credit history, and are likely to have an easier time securing credit. When analyzing credit spreads, all we’re doing is measuring the difference in yield between a. Learn why they matter, how to read. The fico model of credit scoring puts credit scores into six categories: Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying security. When analyzing credit spreads, all we’re doing is measuring the difference in yield between a. It's a crucial economic indicator, and also refers to. The us credit spread includes us aaa credit. Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note. Web compare the yield spreads between corporate bonds, treasury bonds, and mortgages with long maturities. Web a credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. Web a credit spread is the gap between the interest rate offered to investors by a u.s. Web ditch the confusion! This is lower than the. When the spread widens, stock prices are likely to decline. Web the credit risk spread has a negative correlation with the stock market. The us credit spread includes us aaa credit. Web a credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. The american economy has held up well against. Web the higher your score, the better. When analyzing credit spreads, all we’re doing is measuring the difference in yield between a. Web this download contains the latest credit spread fed data for the credit spread regression process. This is lower than the. Web cybersecurity firm crowdstrike suffered a major outage on friday, the company told nbc, impacting businesses globally. See how credit spreads change over time. Individuals in this tier have a positive, above average credit history, and are likely to have an easier time securing credit. Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same underlying security. Web the higher your score, the better. The flags mark the beginning of a recession. When the spread widens, stock prices are likely to decline. Download, graph, and track economic data. Web years of higher inflation and interest rates have left consumers mired in debt, even as overall economy hums. The flags mark the beginning of a recession according to wikipedia. This is lower than the. Web years of higher inflation and interest rates have left consumers mired in debt, even as overall economy hums. Download, graph, and track economic data. See how credit spreads change over time and reflect the credit risk and. Web credit spreads involve the simultaneous purchase and sale of options contracts of the same class (puts or calls) on the same. Treasury bond versus another debt security with the same maturity. Web 740 to 799: It's a crucial economic indicator, and also refers to. See how credit spreads change over time and reflect the credit risk and. Web a credit spread is the gap between the interest rate offered to investors by a u.s. The american economy has held up well against. Learn why they matter, how to read. The outage resulted from an issue. Download, graph, and track economic data. Web a credit spread is the gap between the interest rate offered to investors by a u.s. Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note. Interest rate spreads, 36 economic data series, fred: Web a credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. The outage resulted from. Web a credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. This is lower than the. Web years of higher inflation and interest rates have left consumers mired in debt, even as overall economy hums. Web compare the yield spreads between corporate bonds, treasury bonds, and mortgages with long maturities. When the. In the case of a vertical. It's a crucial economic indicator, and also refers to. This is lower than the. Web ditch the confusion! Interest rate spreads, 36 economic data series, fred: Web 38 rows this interactive chart tracks the daily ted spread (3 month libor / 3 month treasury bill) as a measure of the perceived credit risk in the u.s. Web view data of the spreads between a computed index of all bonds below investment grade and a spot treasury curve. Web compare the yield spreads between corporate bonds, treasury bonds, and mortgages with long maturities. The american economy has held up well against. The outage resulted from an issue. Web the higher your score, the better. The fico model of credit scoring puts credit scores into six categories: Web 740 to 799: Web credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm) and the ytm of a us treasury bond or note. Web when there’s stress on risk assets, it shows up in credit spreads. Learn why they matter, how to read.Credit Spreads Continue To Rise Seeking Alpha

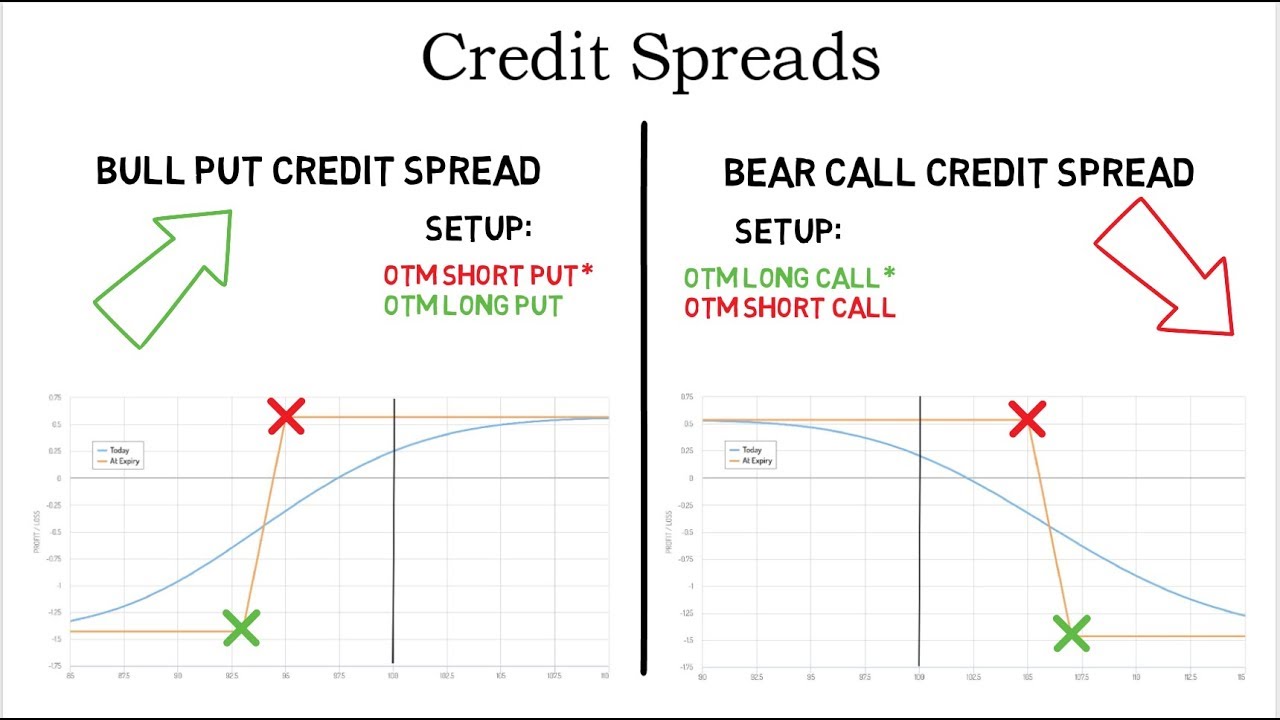

Option Credit Spreads Explained with examples YouTube

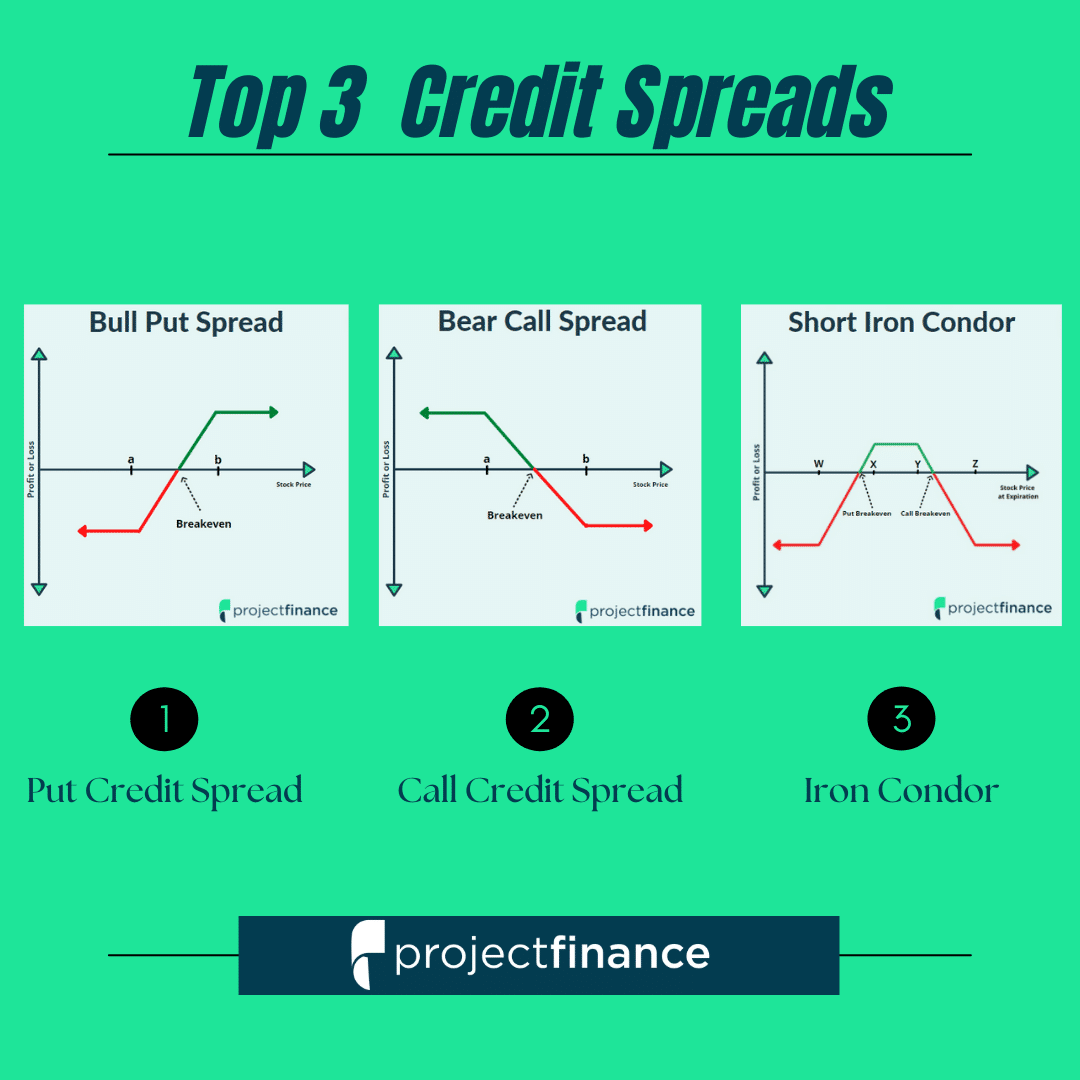

3 Best Credit Spread for Options Strategies projectfinance

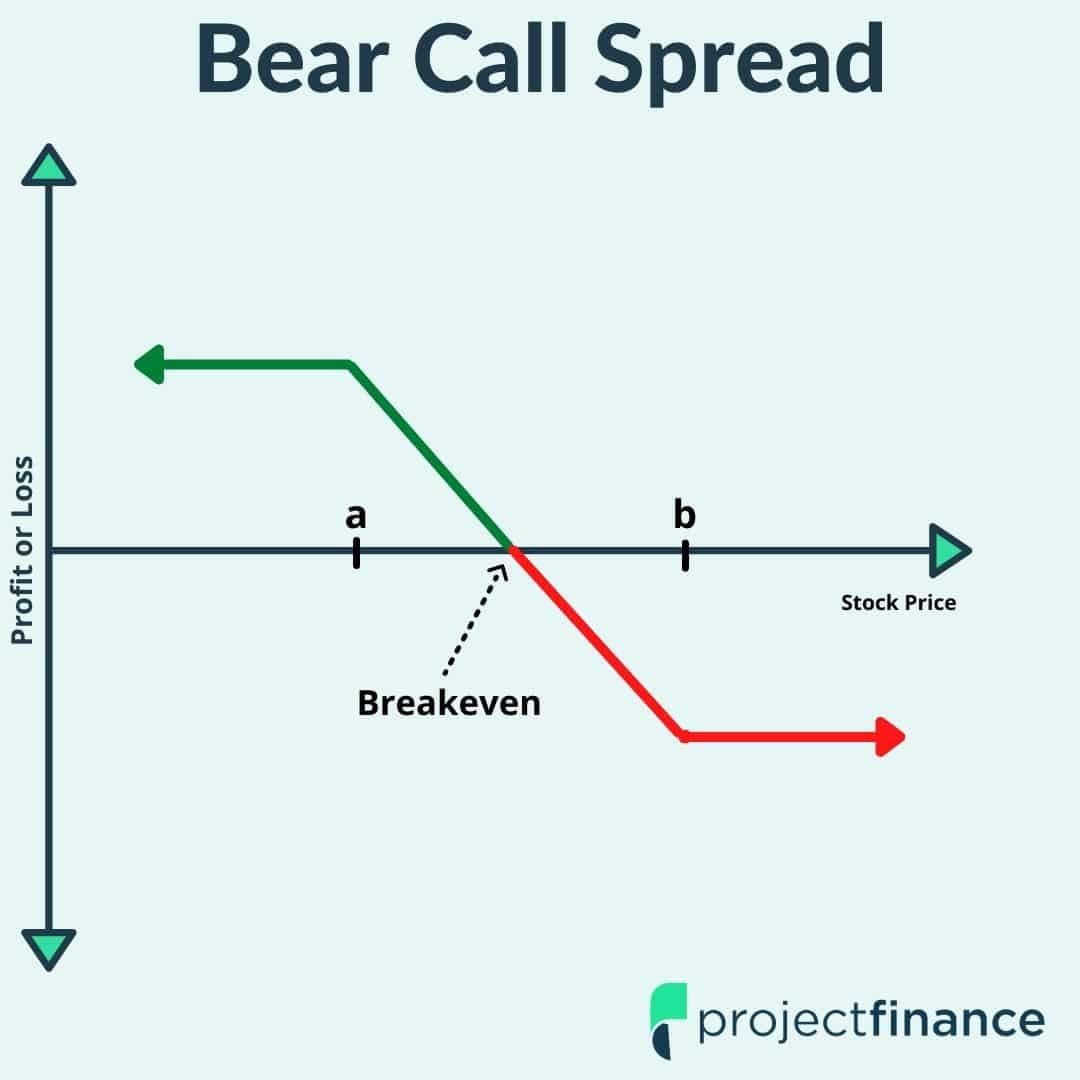

Credit Spread Options Strategies (Visuals and Examples) projectfinance

What credit spreads reveal about share markets

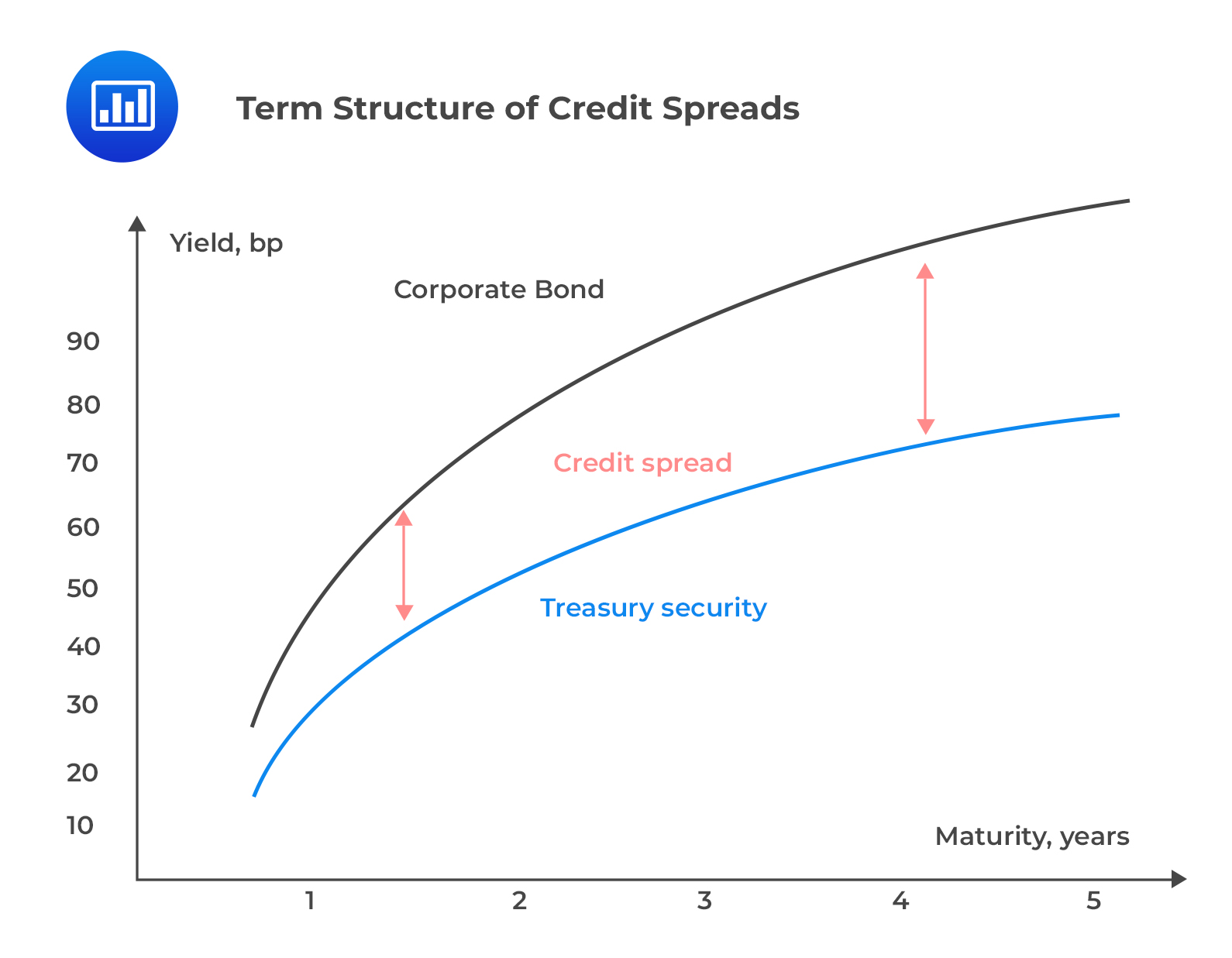

Term Structure of Credit Spreads CFA, FRM, and Actuarial Exams Study

Breaking Down Credit Spreads All Star Charts

a US Dollar corporate credit spreads by rating. b US Dollar corporate

LongTerm Credit Spread Chart September 12, 2016

Web A Credit Spread Is The Gap Between The Interest Rate Offered To Investors By A U.s.

See How Credit Spreads Change Over Time And Reflect The Credit Risk And.

Web The Credit Risk Spread Has A Negative Correlation With The Stock Market.

The Us Credit Spread Includes Us Aaa Credit.

Related Post: