Calculator Whole Life Insurance Cash Value Chart

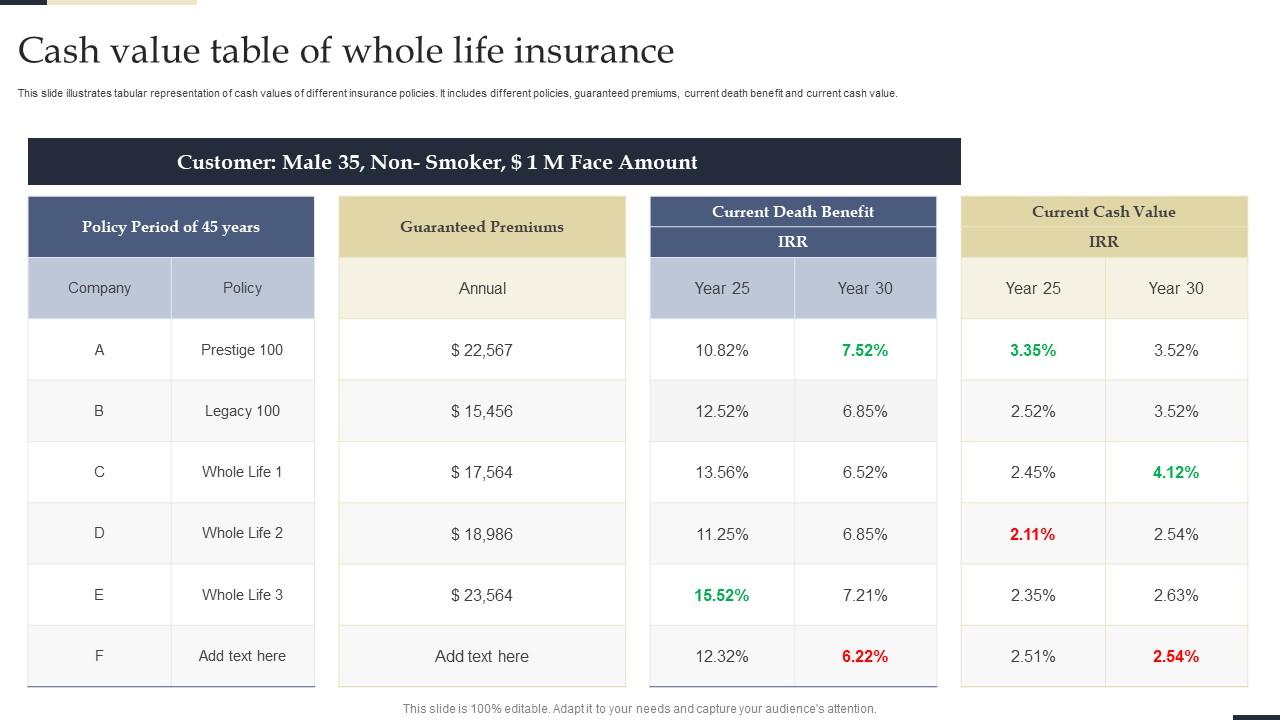

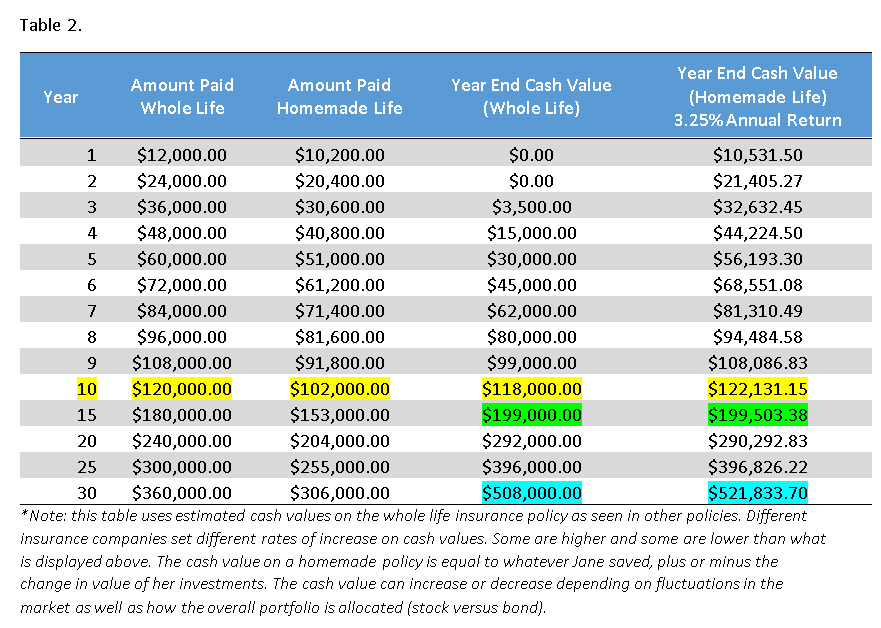

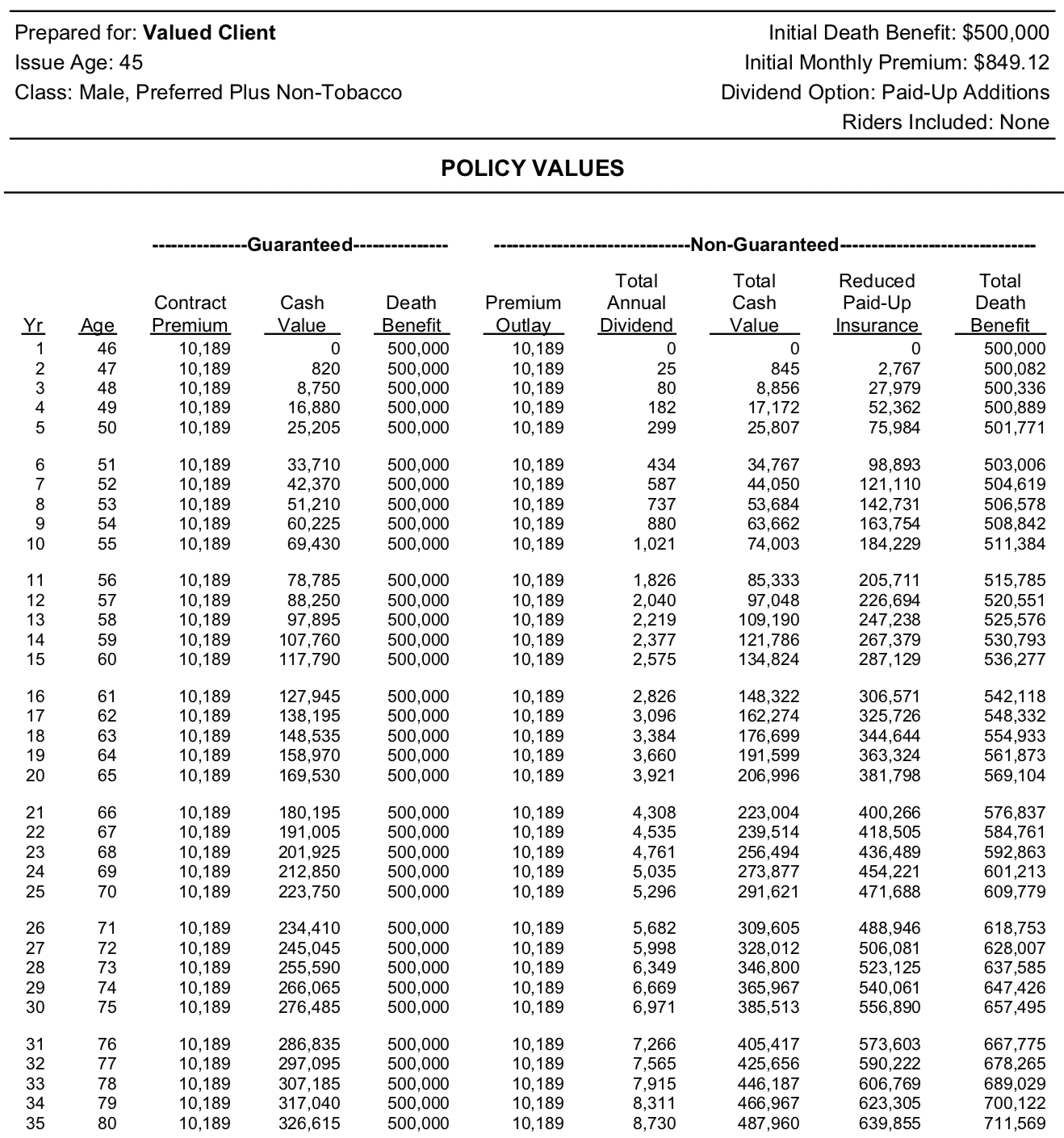

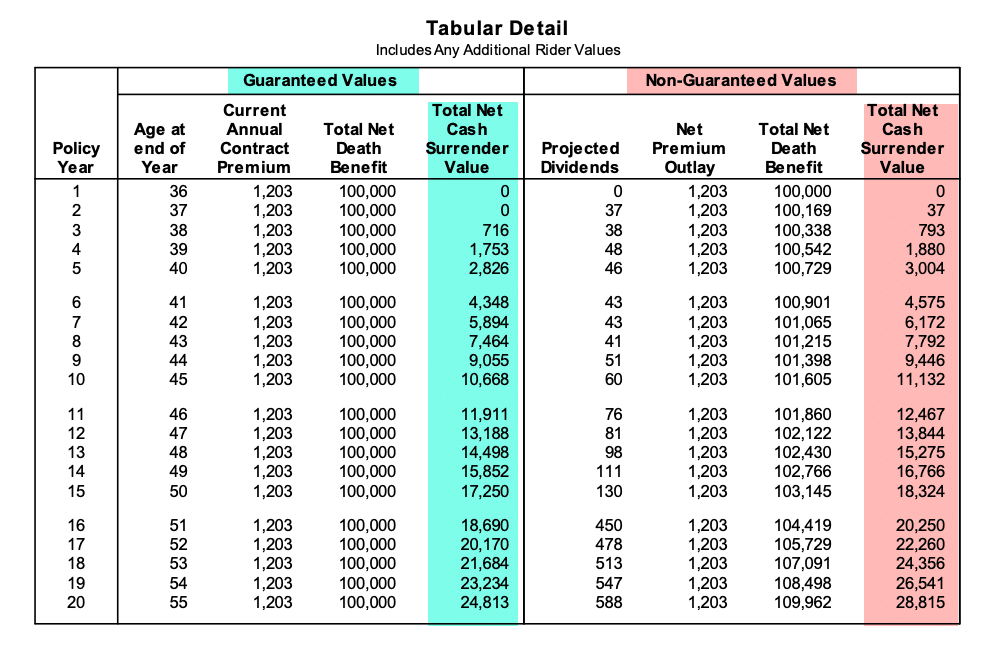

Calculator Whole Life Insurance Cash Value Chart - We will be looking at three different whole life insurance cash value charts. Your insurer may allow you to borrow up to 90% of the cash value. Web whole life insurance cash value chart. Whole life insurance offers a fixed monthly premium, a fixed rate of growth for your cash value and a guaranteed death benefit amount. Web a whole life insurance cost calculator can help you figure out how much insurance you’ll need. Web your whole life insurance cash value chart will track the anticipated cash value of your policy over the years. By contrast, the average annual rate of return on an s&p 500 is just over 10%, as of may 2024. Web if you’re considering a whole life insurance policy, you need to figure out what your needs and goals are, and then calculate how much life insurance you need, how much cash value you will need, and how much it costs you. Whole life insurance interest rates are fixed, with a minimum guaranteed rate. Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the insurance company interest to use it. Policy one designed for maximum death benefit, policy two is designed for accelerated cash value growth, and policy three is focused on maximum early cash value accumulation. Web calculate the cash value of high cash value whole life insurance using this simple online calculator. Web when you buy a term life or whole life policy, you usually start with the death benefit amount you like to have, for example $100,000; Web estimate the cash value of your whole life insurance policy with our online calculator. Web the amount you can borrow depends on the amount of cash value in the policy and your insurer’s rules. Web whole life insurance cash value chart. Whole life insurance has a higher initial premium than an equal amount of term insurance, but don't confuse cost with value. The insured can access this money before the time of their death, differing greatly from term life insurance policies. Web a whole life insurance policy guarantees a fixed rate of return on the cash value, and policyholders with mutual companies may earn additional dividends. Your insurer may allow you to borrow up to 90% of the cash value. Web the cash value of your policy is the accumulated amount of money that gerber life sets aside each time you pay your premium after the initial policy years. Web estimate the cash value of a whole life insurance policy with our online calculator. Web how to access the cash value of your whole life policy. Web if you’re considering. Web whole life features a cash value, which is held in an account that accumulates over time. Or $500,000 and insurance companies will calculate how much monthly premiums you have to pay for that death benefit amount. Web when you buy a term life or whole life policy, you usually start with the death benefit amount you like to have,. We will be looking at three different whole life insurance cash value charts. Web whole life insurance cash value chart. Whole life insurance offers a fixed monthly premium, a fixed rate of growth for your cash value and a guaranteed death benefit amount. The rate at which cash accrues depends primarily on your age and the type of policy you. Web whole life insurance cash value chart. A new york life financial professional can also assist you in finding the right whole life insurance policy for you. The energy giant is on track to grow free cash flow. Web cash value is a unique feature of a permanent life insurance policy that allows you to build up cash and borrow. Web cash value life insurance provides both lifelong coverage and an investment account. What can you use whole life cash value for? Web a whole life insurance policy guarantees a fixed rate of return on the cash value, and policyholders with mutual companies may earn additional dividends. Whole life insurance offers a fixed monthly premium, a fixed rate of growth. Web whole life features a cash value, which is held in an account that accumulates over time. Whole life insurance interest rates are fixed, with a minimum guaranteed rate. For example, if the policy. Web a healthy balance sheet is essential for supporting a growing payout. Web whole life insurance cash value chart. Web whole life features a cash value, which is held in an account that accumulates over time. A new york life financial professional can also assist you in finding the right whole life insurance policy for you. Web estimate the cash value of a whole life insurance policy with our online calculator. Web your whole life insurance cash value chart. Web whole life insurance cash value chart. Web a whole life insurance cost calculator can help you figure out how much insurance you’ll need. The insured can access this money before the time of their death, differing greatly from term life insurance policies. Whole life insurance has a higher initial premium than an equal amount of term insurance, but don't. Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the insurance company interest to use it. Web these charts will clearly show you how much cash value your whole life insurance has accrued. You’ll also need to enter information. What kind of life insurance policies have cash value? Variable and indexed universal life policies accumulate cash value differently. Web cash value is a unique feature of a permanent life insurance policy that allows you to build up cash and borrow from your policy. Whole life insurance has a higher initial premium than an equal amount of term insurance, but. Variable and indexed universal life policies accumulate cash value differently. Web how is cash value in whole life policy different from cash value in indexed or variable universal life policy? Web ramsey added that the average whole life policy earns a 1.2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the insurance company interest to use it. (if it were purchased at age 40, age 50, age 60, and age 70.) The benefits of lifetime coverage, and over time the guaranteed cash value and the eligibility to earn dividends, makes whole life a good choice for. Web cash value life insurance provides both lifelong coverage and an investment account. Web a whole life insurance policy guarantees a fixed rate of return on the cash value, and policyholders with mutual companies may earn additional dividends. The energy giant is on track to grow free cash flow. Web whole life insurance cash value chart. Web the reality of whole life insurance. A new york life financial professional can also assist you in finding the right whole life insurance policy for you. Web the cash value of your policy is the accumulated amount of money that gerber life sets aside each time you pay your premium after the initial policy years. You’ll also need to enter information like your age, gender, and coverage amount. Web whole life features a cash value, which is held in an account that accumulates over time. Web how to access the cash value of your whole life policy. Web the amount you can borrow depends on the amount of cash value in the policy and your insurer’s rules.Cash Value Table Of Whole Life Insurance

How To Calculate Premiums On A Whole Life Policy

Whole Life Long Term Cash Value • The Insurance Pro Blog

How to Create Your Own Whole Life Insurance Policy — Origin Wealth Advisers

Whole Life Cash Value Explained Photos All

Calculator Whole Life Insurance Cash Value Chart

Whole Life Insurance Cash Value Chart

How Much Does Whole Life Insurance Cost? Effortless Insurance

Whole Life Insurance Calculator Cash Value

Whole Life Insurance Cash Value Chart [3 Great Examples] I&E Whole

Web Estimate The Cash Value Of Your Whole Life Insurance Policy With Our Online Calculator.

Web When You Buy A Term Life Or Whole Life Policy, You Usually Start With The Death Benefit Amount You Like To Have, For Example $100,000;

We Will Be Looking At Three Different Whole Life Insurance Cash Value Charts.

Web If You’re Considering A Whole Life Insurance Policy, You Need To Figure Out What Your Needs And Goals Are, And Then Calculate How Much Life Insurance You Need, How Much Cash Value You Will Need, And How Much It Costs You.

Related Post:

![Whole Life Insurance Cash Value Chart [3 Great Examples] I&E Whole](https://www.insuranceandestates.com/wp-content/uploads/policy-charts.jpg)