Cafe Chart Of Accounts

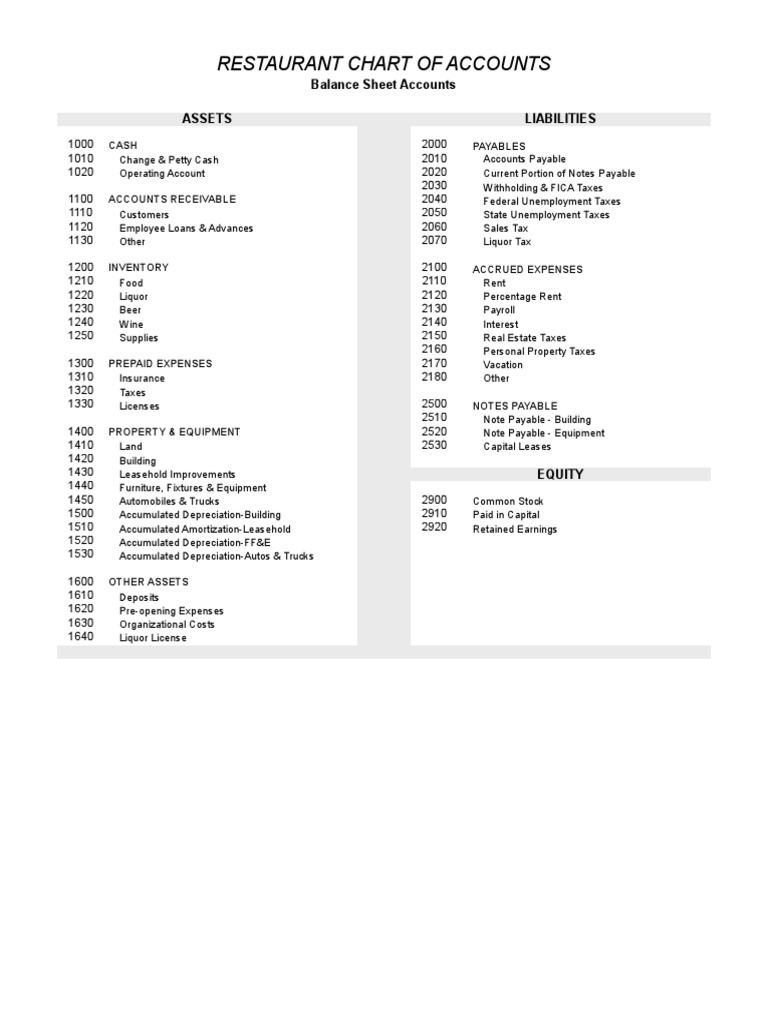

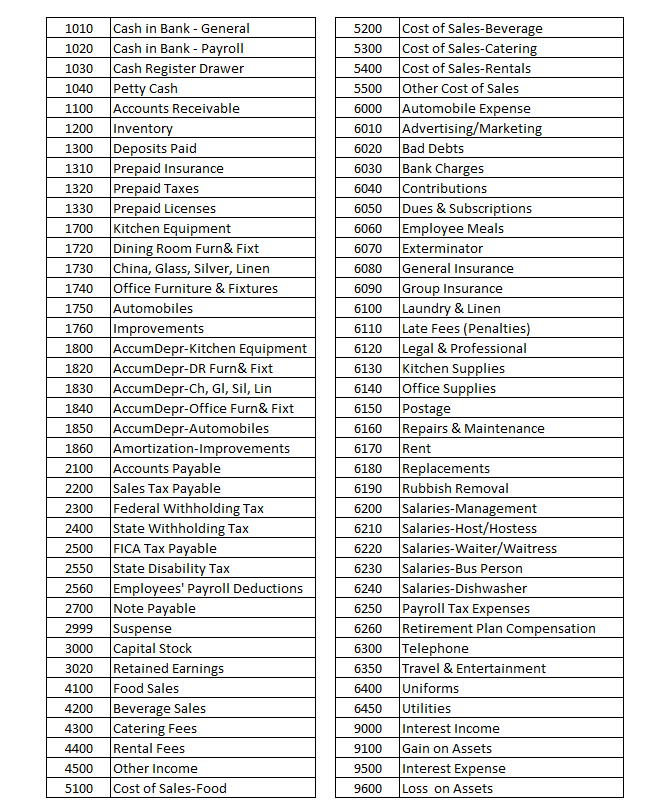

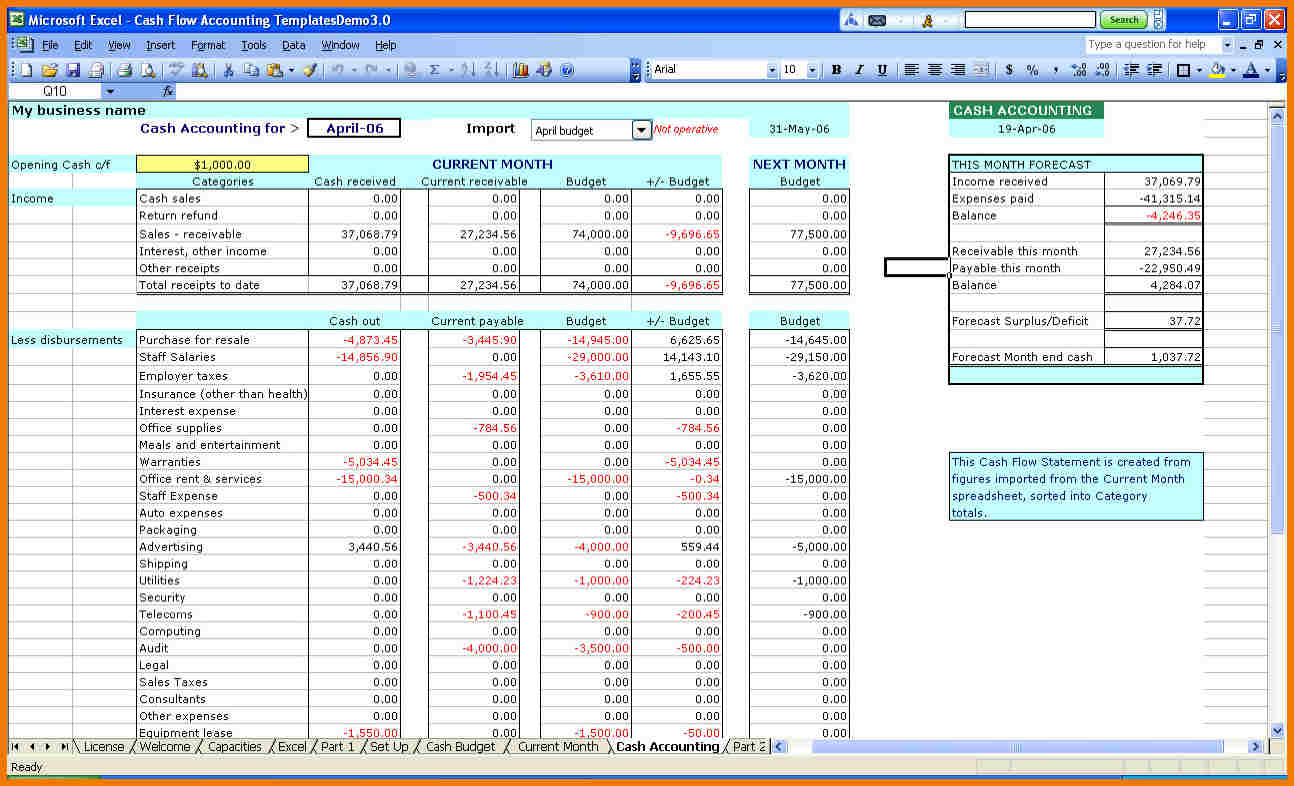

Cafe Chart Of Accounts - Worse, some use business bank accounts like their own personal spending account. Use the cost code guide to consistently code your operating expenses and other costs to the correct or most appropriate account. Web entrepreneurs whose books and accounts are in a mess are taking a big risk with their business. Thank you very, very much. We highlight all the restaurant income, cost of goods and expense accounts. Web a chart of accounts allows you to look at a clear picture of where all your money is going and coming from. Web maldives reinstated and expanded a daily “green tax” on tourist visits in 2022. Find your nearest chart house and view menus. Simpler coas provide a system for documenting all credits and debits. It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business. It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business. Often, they they think the business is doing better than it is, because they can see money trickling in. Web entrepreneurs whose books and accounts are in a mess are taking a big risk with their business. 10001 chesham dr, orlando, fl 32817 website Thank you, kid rock, sometimes referred to as “bob.” and thank you, lee, right from the beginning, thank you very much. Web what is a restaurant chart of accounts? We highlight all the restaurant income, cost of goods and expense accounts. A restaurant chart of accounts is a tool that allows you to track and manage your financial transactions in an organized way. Web running a restaurant involves juggling numerous financial transactions, from managing inventory to tracking expenses and revenue. That’s where a restaurant chart of accounts comes in. Web thank you very much. Cafe news & related stories. Web but to get these valuable insights, you need to know how to read a restaurant chart of accounts and interpret what it’s telling you. It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business. Web by convention,. Web thank you very much. Web introduction restaurant and cafe accounting. Web just as a chef meticulously selects each component for its contribution to flavor and texture, a restaurant's chart of accounts serves as the framework, meticulously organizing costs like cogs, wages, and utilities to create a balanced and profitable recipe for success. It’s a complete, coded list of all. Web just as a chef meticulously selects each component for its contribution to flavor and texture, a restaurant's chart of accounts serves as the framework, meticulously organizing costs like cogs, wages, and utilities to create a balanced and profitable recipe for success. Web a restaurant chart of accounts serves as the foundation for all accounting activities within your establishment. We. Simpler coas provide a system for documenting all credits and debits. Often, they they think the business is doing better than it is, because they can see money trickling in. Restaurateurs need an organized financial framework to maintain control and make informed decisions. Find your nearest chart house and view menus. Find cafe (cafe) cryptocurrency prices, market news, historical data,. It helps you have a deeper look into your restaurant’s current financial position and provides sufficient helpful insights to project future trends of its financial performance. Simpler coas provide a system for documenting all credits and debits. Use the cost code guide to consistently code your operating expenses and other costs to the correct or most appropriate account. Web introduction. We highlight all the restaurant income, cost of goods and expense accounts. Web but to get these valuable insights, you need to know how to read a restaurant chart of accounts and interpret what it’s telling you. Here’s the skinny on restaurant charts of accounts and how you can make a useful one. That’s where a restaurant chart of accounts. Employer identification number (ein) 461433848: Web this is where a chart of accounts comes into play — an organized system that will help you better understand how your restaurant makes money and where that money is spent. Web entrepreneurs whose books and accounts are in a mess are taking a big risk with their business. Web running a restaurant involves. Web providing 19 receptions and 255 yards, morlock accounts for almost all of the returning production in the te room as the group only retains 27.1% of its catches from last season. Web but it’s ultimately reflected in a restaurant’s chart of accounts, which is a manager’s mise en place, immaculate refrigerator, and financial oracle. Web restaurant chart of accounts. It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business. Web this is the default chart of accounts we use for simple restaurant accounting. It helps you have a deeper look into your restaurant’s current financial position and provides sufficient helpful insights to project future trends of its. Web but it’s ultimately reflected in a restaurant’s chart of accounts, which is a manager’s mise en place, immaculate refrigerator, and financial oracle. Here’s the skinny on restaurant charts of accounts and how you can make a useful one. What's in a restaurant's chart of accounts? It helps you have a deeper look into your restaurant’s current financial position and. Web restaurant chart of accounts & cost coding guide. Worse, some use business bank accounts like their own personal spending account. That’s where a restaurant chart of accounts comes in. Often, they they think the business is doing better than it is, because they can see money trickling in. A restaurant chart of accounts is a tool that allows you to track and manage your financial transactions in an organized way. Web maldives reinstated and expanded a daily “green tax” on tourist visits in 2022. Cafe news & related stories. Employer identification number (ein) 461433848: Thank you, kid rock, sometimes referred to as “bob.” and thank you, lee, right from the beginning, thank you very much. It includes all the accounts we believe the average restaurant will need, and combines some common accounts that are rarely used by smaller businesses. Web what is a restaurant chart of accounts? It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business. Web this is the default chart of accounts we use for simple restaurant accounting. Web a chart of accounts allows you to look at a clear picture of where all your money is going and coming from. Simpler coas provide a system for documenting all credits and debits. Web by convention, a chart of accounts for restaurants is broken up into sections for (at a minimum) operating revenue, assets, liabilities, operating expenses, and equity, with additional categories that vary by a business’s unique needs.Chart of Accounts Restaurant Tableware Taxes

Chart Of Accounts For Restaurant Sample

Chart Of Accounts For Restaurant

Restaurant Chart Of Accounts XLS Organize Your Financials With Ease

Restaurant Chart of Accounts & Cost Coding Guide RestaurantOwner

RestaurantSpecific Chart of Accounts for QuickBooks Online

Restaurant Chart Of Accounts Template

Restaurant Chart of Accounts

Restaurant Chart of Accounts CheckMark Knowledge Base

Restaurant Chart Of Accounts Template

Web Entrepreneurs Whose Books And Accounts Are In A Mess Are Taking A Big Risk With Their Business.

Web Just As A Chef Meticulously Selects Each Component For Its Contribution To Flavor And Texture, A Restaurant's Chart Of Accounts Serves As The Framework, Meticulously Organizing Costs Like Cogs, Wages, And Utilities To Create A Balanced And Profitable Recipe For Success.

10001 Chesham Dr, Orlando, Fl 32817 Website

Thank You Very, Very Much.

Related Post: